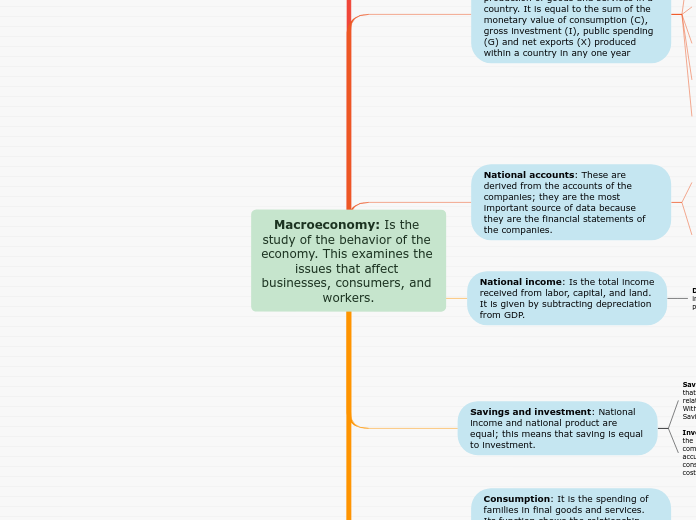

Macroeconomy: Is the study of the behavior of the economy. This examines the issues that affect businesses, consumers, and workers.

Offer and demand

Offer: The producers offer goods to make a profit

Demand: It is the amount of goods that individuals acquire depending on their price. If the market value is low, more units are acquired.

Substitution effect: This occurs because goods become relatively more expensive when their price rises

Income effect: This occurs when the price of goods rises, and one is somewhat poorer than before

Gross Domestic Product (GDP): Is the measure that covers the total production of goods and services in a country. It is equal to the sum of the monetary value of consumption (C), gross investment (I), public spending (G) and net exports (X) produced within a country in any one year

Measurement

Product flow approach: buyers acquire the final and consumed goods and services almost immediately; families spend their income on these consumer goods

Income approach: It is the annual luxury of production costs, where all the costs of doing business flow, being the total income of the factors (wages, interests, rents, and profits) that are the costs of obtaining the final products of society

Nominal GDP: Represents the total value in money of the final goods and services produced in a respective year, where the values are expressed in terms of market prices for each year.

Real GDP: This removes price changes from nominal GDP and calculates GDP in terms of the quantities of goods and services.

Net Domestic Product (NDP): is the total final product produced within a country during a year, where production includes net investment, or gross investment minus depreciation

Gross National Product (GNP): it is the total final product produced with inputs that are owned by the residents of this for one year.

National accounts: These are derived from the accounts of the companies; they are the most important source of data because they are the financial statements of the companies.

The “double counting” problem: A final product is a product that is manufactured and sold for consumption or investment. GDP excludes intermediate goods, goods that are used to make other goods. In calculating GDP from the product flow side, the exclusion of intermediate products does not pose any major complications.

The “added value” in the lower circuit: The added value is the difference between the sales of a company and its purchases of materials and services from other companies.

National income: Is the total income received from labor, capital, and land. It is given by subtracting depreciation from GDP.

Disposable personal income: Market and transfer income received by families are calculated, and personal taxes are subtracted.

Savings and investment: National income and national product are equal; this means that saving is equal to investment.

Saving: It is the part of disposable personal income that is not consumed. The saving function shows the relationship between the level of saving and income. With higher income, saving increases

Savings = income – consumption

Marginal propensity to save: this is defined as the fraction of an additional dollar of disposable income that goes into savings. Each additional dollar of disposable income must be divided by additional consumption and savings.

Investment: investment performs two functions in the macroeconomy: It is an important and volatile component of spending and leads to the accumulation of capital. When investing you should consider three essential elements, such as: income, costs, and expectations.

Income: An investment is profitable when it generates additional income that contributes to a greater sale of products.opic

Consumption: It is the spending of families in final goods and services. Its function shows the relationship between the level of consumer spending and the level of personal income. Consumption is divided into three categories: Durable goods, non-durable goods, and services

The marginal propensity to consume: It is the extra amount that people consume when they receive an extra monetary unit of disposable income.

National consumption function: This shows the function of the level of consumption spending and the level of disposable personal income.

Price stability: It is defined as a low and stable inflation rate

Price index: It is the weighted average of the price of a basket of goods and services. Economists weight individual prices by the economic importance of each good.

Consumer Price Index: Measure of the average price paid by urban consumers for a market basket of consumer goods and services.

GDP price indices: It is the price of all goods and services produced in the country instead of a single component.

Producer Indices (PPI): Measures the price level at producer or wholesale prices. It is based on more than 8,000 commodities

Inflation rate: Percentage change in the general price level from one year to the next