PROJECT EVALUATION

It is a very useful tool for decision-making by financial managers, since an analysis that anticipates the future can avoid possible deviations and problems in the long term.

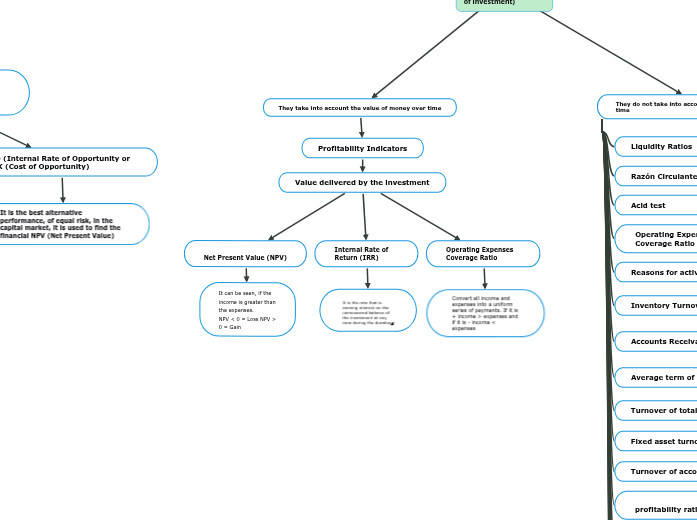

Evaluation methods or PRI (Recovery period of investment)

They take into account the value of money over time

Profitability Indicators

Value delivered by the investment

Net Present Value (NPV)

It can be seen, if the income is greater than the expenses.

NPV < 0 = Loss NPV > 0 = Gain

Internal Rate of Return (IRR)

Operating Expenses Coverage Ratio

Convert all income and expenses into a uniform series of payments. If it is + income > expenses and if it is - income < expenses

They do not take into account the value of money over time

Liquidity Ratios

Ability to pay short-term debts

Razón Circulante

current ratio

Acid test

Measures the liquidity of its most liquid assets with liabilities due to expire in the short term

Operating Expenses Coverage Ratio

Ability of the company to cover basic operating costs

Reasons for activity

Measures the efficiency of the company in the administration of its assets

Inventory Turnover

Accounts Receivable Turnover (RCC)

Represents the number of times that the commercial cycle is fulfilled in the period to which net sales refer

Average term of accounts receivable (PPCC)

Indicates the average period of time required to collect outstanding accounts

Turnover of total assets

Number of times investment in total assets has generated sales

Fixed asset turnover

Number of times the investment in fixed assets has been sold

Turnover of accounts payable (RCP)

Speed with which accounts payable have been created.

profitability ratios

Measures the success of the company in a certain time

Gross Profit Margin

Measures the proportion of sales that turn into profit or loss

return on investment

Measures the proportion of investments that turn into profit or loss

Return on Average Total Assets

Measures financial success of average total assets

coverage reasons

Helps assess the solvency of the company

debt ratio

Shows the percentage of the total investment in assets that has been financed by creditors

reason for stability

Relationship between total liabilities and stockholders' equity. If it is >1, it indicates that the company has leverage of more than 50%.

interest coverage

Measures the company's ability to cover interest payments on debts incurred

Added economic value

EVA = Operating Income - Capital Costs - Taxes

Added Market Value

MVA = Market Value of the company - Capital Invested to date

Interest-paying ability ratio

Project Free Cash Flow (FCL)

Methodologies

direct method

NOPAT method

EBITDA method

Operating profit + depreciation and amortization of intangibles

Shareholder Cash Flow

It is what the project leaves to the shareholder after covering its costs, paying its taxes, executing the necessary investments for the operation of the business and paying creditors.

Project value generation

The value is generated as long as the company or project delivers a higher return than the minimum rate that investors demand to place their funds in it.

WACC (The Weighted Average Cost of Capital)

It is the discount rate that should be used to determine the present value of a future cash flow.

TIO (Internal Rate of Opportunity or COK (Cost of Opportunity)

It is the best alternative performance, of equal risk, in the capital market, it is used to find the financial NPV (Net Present Value)

All updated revenues and costs must be added, using the WACC or COK as a discount rate, depending on whether the FCL or FCA is used, and then divide them, having a result for decision making and summarized as follows: BI/C > 1 approve (revenues greater than costs) =1 Approve and <1 reject (indicates that revenues are less than costs)