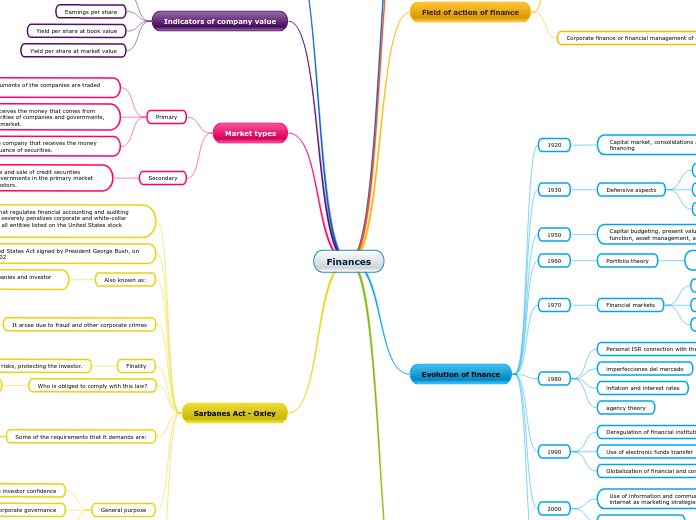

Finances

Finance concept

Finance is the branch of economics that is related to the study of investment activities both in real assets and in

financial assets and their administration

Types of Assets

Real

Tangible asset, used to generate resources

Financial

It constitutes the right to collect an account.

Field of action of finance

Investments

How to make and how to manage an investment in financial assets.

Institutions and financial markets

They specialize in selling, buying, creating credit titles and securities.

Corporate finance or financial management of companies.

Physical person with business

Create wealth for the shareholder

Increasing importance of financial management

Responsibilities of the financial manager

Long-term planning and budgeting

Investment decisions and financing of capital goods and inventories

Administration of accounts receivable and cash

Coordination and control of operations

Relationship with financial markets

Evolution of finance

1920

Capital market, consolidations and mergers, liquidity and financing

1930

Defensive aspects

Bankruptcy

Liquidations

Reorganizations

1950

Capital budgeting, present value, time value of money function, asset management, analysis for decision making

1960

Portfolio theory

Marginal contribution of each asset to the overall risk of the company's portfolio.

1970

Financial markets

Possibility of negotiating debt and capital securities

Arbitrage pricing model

Option pricing model

1980

Personal ISR connection with the company's ISR

imperfecciones del mercado

inflation and interest rates

agency theory

1990

Deregulation of financial institutions

Use of electronic funds transfer

Globalization of financial and commercial operations

2000

Use of information and communication technologies and the internet as marketing strategies

Stakeholder participation

2010

Convergence of financial information

Risk management

The value of intangible assets

Sustainable development projects of organizations

Types of financial manager decisions

Investment

Financing

Asset Management

Dividend policy

Dividend theories

'' RESIDUAL THEORY OF DIVIDENDS ''

The profits generated in a period of operations must be allocated to projects whose profitability meets the expectations of the shareholders; if profits are still available, dividends must be shared among them.

Signaling theory

It establishes that shareholders always expect dividends as a sign of the good performance of the company. Dividends are a priority that should not be neglected.

Indicators of company value

Net profit

Earnings per share

Yield per share at book value

Yield per share at market value

Market types

Primary

The shares or debt instruments of the companies are traded on the stock market.

It is the company that receives the money that comes from the issuance of debt securities of companies and governments, issued through the stock market.

In public issues, it is the company that receives the money that comes from the issuance of securities.

Secondary

The transactions of purchase and sale of credit securities issued by companies and governments in the primary market are negotiated between investors.

Sarbanes Act - Oxley

It is the law that regulates financial accounting and auditing functions and severely penalizes corporate and white-collar crime against all entities listed on the United States stock exchange.

It is a United States Act signed by President George Bush, on July 30, 2002

Also known as:

Act of Reform of public accounting of companies and investor protection (SOX, SarbOx)

It arose due to fraud and other corporate crimes

Most renowned cases

Enron

Xerox

WorldCom

Finality

Avoid fraud and bankruptcy risks, protecting the investor.

Who is obliged to comply with this law?

All listed companies and their subsidiaries

Some of the requirements that it demands are:

Establish a new council, overseen by the SEC

Define new responsibilities and functions of the audit committee, which should have members independent of the administration.

That the managers accompany the reports with a personal certification

General purpose

Restore investor confidence

Improve corporate governance

Control activities at the corporate level

Reinforced

The application of the report (COSO)

Establish internal controls in companies

Establish an application guide

Monitoring of these controls