Who Ate My Cake: The Digital Transformation of Banks in Africa

Future of Retail Banking

Transforming Traditional Banks

Executive Summary

The Enemies on the Horizon: FinTech, E-Commerce, Telecoms, Social Networks, Search Engines, Global Banks & Insurance Companies.

The Unforseable African Economy

Income Growth & Inequality

Millenial Population & Digital Usage

Opportunities from Migration

Economic Diversification

The Four Apocalypse of Banking

Disintermediation

Unbundling

Invisibility

Commoditisation

New Banking Models

Bank-as-a-Service

Advisory & Advertising

E-commerce capabilities

Transaction Fees: In-app purchases

Media & Entertainment

Games

Social Banking

Building New Capabilities

Digital Capabilities

Cybersecurity

Big Data & Analytics

A.I. and Robotic Process Automation

Cloud Computing

Revamping IT

Talent Management

Leadership & Execution

Culture & Change Management

Collaboration & Breaking Down Silos

A New Evaluation System

Attracting Tech Talent

All Star Talent Scheme

Linking KPIs to Responsibility

Innovation Strategy

External Strategic Process: 1) Digital & Non-Digital M&A; 2) Open Innovation & Coopetition; 3) Beyond Listening to Markets; 4) Shaping Regulation

Competing with Traditional Banks and Non-Banks.

Organisational Design: Structural & Contextual Ambidexterity

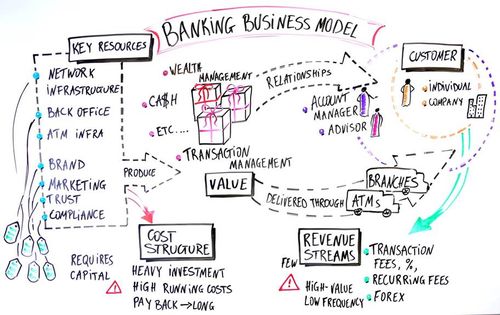

Banking Operating Models

save time

make info

interesting

easier to remember

Designing Experiences & Touch Points

Banking Relationship Channels

Cardless ATM Channels: Cheque & Cash Deposit, Remittances & FX Transactions.

Digital Banking

Robo-advisory in Wealth Management

Mobile Banking

Banking in Social Networks: The WeChat Model

Self-Service Branch of the Future

Onboarding Process

Fully Digital Onboarding

The Deloitte Banking Onboarding Process