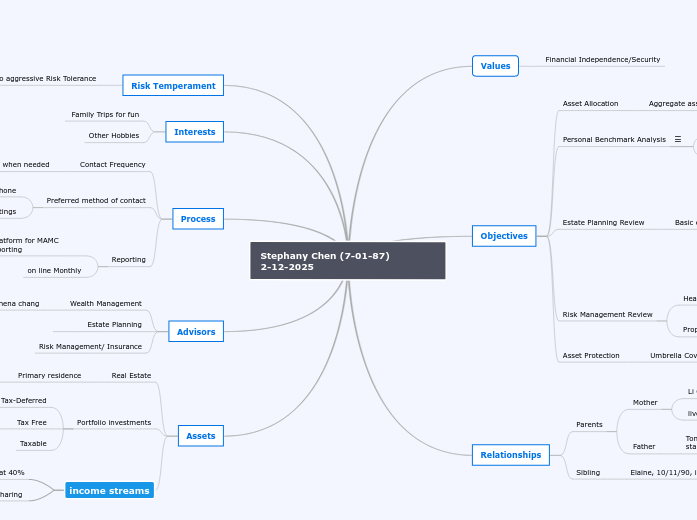

Stephany Chen (7-01-87) 2-12-2025

Values

Financial Independence/Security

Objectives

Asset Allocation

Aggregate asset allocation

Coordinate asset location among different MAMC accounts

Personal Benchmark Analysis

Retirement

Purchase Residence in 2-3 years time

Estate Planning Review

Basic estate planning documents

Wills,

Trusts,

Power of Attorney,

Medical Directives,

Health Care Power of Attorney,

Risk Management Review

Health insurance

Property insurance

Asset Protection

Umbrella Coverage

Risk Temperament

moderate to aggressive Risk Tolerance

Relationships

Parents

Mother

Li Chuan 67

lives in San Diego CA in good financial standing

Father

Tony 69 , lives in San Diego CA in good financial standing

Sibling

Elaine, 10/11/90, in NJ Fashion Marketing

Interests

Family Trips for fun

Other Hobbies

Process

Contact Frequency

Annual and when needed

Preferred method of contact

e-mail or phone

In person for review meetings

Reporting

Web reporting via Orion Platform for MAMC Performance quarterly reporting

on line Monthly

Advisors

Wealth Management

MAMC, Athena chang

Estate Planning

Risk Management/ Insurance

Assets

Real Estate

Primary residence

Portfolio investments

Tax-Deferred

Tax Free

Taxable

income streams

Base Salary $280,000 with bonus at 40%

Revenue Sharing