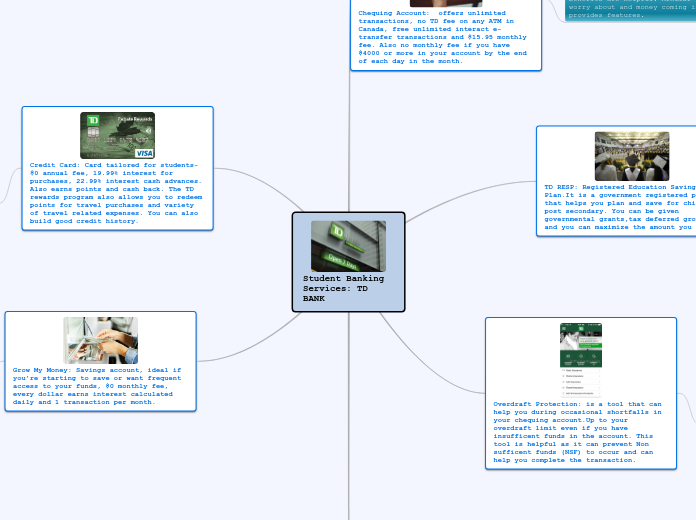

Student Banking Services: TD BANK

Chequing Account: offers unlimited transactions, no TD fee on any ATM in Canada, free unlimited interact e-transfer transactions and $15.95 monthly fee. Also no monthly fee if you have $4000 or more in your account by the end of each day in the month.

Benefits: It is all specific for a student. The expense is minimal and the benefits are helpful. Minimal fees to worry about and money coming in also provides features.

TD RESP: Registered Education Savings Plan.It is a government registered plan that helps you plan and save for child's post secondary. You can be given governmental grants,tax deferred growth and you can maximize the amount you save.

Benefits: The RESP is extremely beneficial to students as it can help aid them pay tuition while also maximizing the amount of money they save, which is also helpful in the long run. Overall, it is well tailored for a college or university student.

Overdraft Protection: is a tool that can help you during occasional shortfalls in your chequing account.Up to your overdraft limit even if you have insufficent funds in the account. This tool is helpful as it can prevent Non sufficent funds (NSF) to occur and can help you complete the transaction.

Benefits: This tool is extremely beneficial for students in tough times. As a student you do not have enough money to pay for everything as expenses can add up. Therefore, when you are in desperate need this tool can help a successful transaction to occur and avoid NSFs.

Borrowing: Apply once for a credit limit that you can use and reuse while in school, interest only monthly payments while in school and 24 months after you leave. Manage payment once you leave school as your line of credit will be converted to a student loan with comfortable fixed payments

Benefits: This concept is tailored specifically for students. You can use the credit limit until needed, the interests rates are handled and interests payments are paid accordingly. Once you finish school the line of credit payment will also be covered to manage. Everything works accordingly to a student lifestyle.

Credit Card: Card tailored for students- $0 annual fee, 19.99% interest for purchases, 22.99% interest cash advances.

Also earns points and cash back. The TD rewards program also allows you to redeem points for travel purchases and variety of travel related expenses. You can also build good credit history.

Benefits: This is beneficial to college/university students as you are able to keep your expenses to a minimum (no annual fee) and you also earn rewards and points, which is an easy to achieve beneficial features. It also helps you build good credit history for future needs. Helpful for future.

Grow My Money: Savings account, ideal if you’re starting to save or want frequent access to your funds, $0 monthly fee, every dollar earns interest calculated daily and 1 transaction per month.

Benefits: As a student, you want to save for your future after post secondary. This savings accounts limits your expenses and adds to your savings. It has a $0 monthly fee, and every dollar earns interest calculated daily with a limited transaction.