The Political Spectrum

Socialism (France)

Medical Insurance - Maternity Leave

- France’s Family Allowance laws allow men and women to continue to receive full-time salary while on maternity leave, and then stipends to help make sure that their quality of life does not suffer after having children. This not only ensures that newborns have ample time with their parents, but also allows for higher employment rates.

- France has the Family Allowance laws, and subsidized childcare.

- In France women are paid full-time salary up to 16 weeks after having a new baby and men are allowed 11 days with full pay.

- 60% of French women and 68% of French men are employed fulltime. Even after taking off days or weeks of paid maternity leave, their careers stay intact.

- France not only allows for paid maternity leave but even has almost 3% of the GDP budget that is specifically allocated to these couples.

The total allowance rises to 34 weeks for twins and 46 for triplets. Paternity leave of 11 days, also paid by social security depending on contributions, is available to fathers. France also provides child benefit for two children or more aged under 20, regardless of employment history.

Unemployment Insurance Benefits & Supplements

- Workers aged under 50 can claim unemployment benefit for two years, while those aged over 50 can claim for three years. On average, benefits are about 65% of employees’ salary.

- To qualify, people must be registered with the Pôle Emploi job centres and be actively seeking work. For those who haven’t worked for long enough to qualify, or at all, the RSA (Revenu de Solidarité Active) is a safety net, providing a minimum wage for the unemployed.

- A childless single person can receive €514 per month, and a couple with two children €1,079.

- French sick pay can be claimed if employees have contributed to the state-run insurance scheme, the benefit totals 50% of the daily net wage. The conditions require beneficiaries to have worked for 200 hours over a period of three months before claiming the benefit or to have paid contributions on a salary of at least €9,754 for the six months beforehand.

- Claimants with three dependent children or more receive 66% of their daily net wage. Unemployed people can also obtain sick pay at a daily maximum rate of €43 if they receive unemployment benefit or have been out of work for 12 months or less. Until now, parents have received a flat rate of €129 per month for two children, rising to €461 for four.

- Tax credits – paid as a refund – are available for low earners with salaries below €16,251 for a single person or €32,498 for a couple.

- Disability benefits are calculated according to the individual’s average salary over a 10-year period. If claimants can work, the rate is based on 30% of the claimant’s average salary over the decade and can range from €282 to €951 per month. For those no longer able to work, a higher rate of 50% is used, up to a ceiling of €1,585 per month. Those who cannot work and require care receive the same scale of benefits as this second group, but also get €1,104 per month to pay for a carer. - Disabled adults who have never worked can claim a monthly allowance of between €403 (for a single person) and €666 (for a couple), as long as they do not have financial resources of more than €800 per month (for single person) and €1,600 (for couples).

- Disability benefits are also available for parents looking after disabled children under 20 who are living at home. They cover education, and the employment of a carer, but are means-tested and the benefits depend on the severity of the child’s disability.

Corporate Taxes

In 2020, the corporate taxes for France is 32.02%.

Gross Salary After Tax Tax Rate

€28 000 €19 294 31.1%

€45 000 €26 616 40.9%

€113 000 €45 945 59.3%

- The "after tax" is how much money leftover after paying taxes and contributing for social benefits.

- If we were to only take taxes into consideration, these rates would be much closer, and French people might actually pay a little less than the USA.

- In France, it’s mandatory to contribute to social benefits.

Far Left

What Does It Mean?

Far-left politics involve violent acts and the

formation of far-left militant organizations

meant to abolish capitalist systems and the

upper ruling class. Far-left terrorism consists

of groups that attempt to realize their radical

ideals and bring about change through violence

rather than established political processes.

Example

Communism

Corresponding Economic Systems

Command Economies:

- The government regulates the amount, distribution, and price of goods and services

- The govt restricts and controls the ownership of private property

- More government control means that the profit motive is not the overriding goal of the business

- The needs of the entire society are considered before the individual’s needs

- The state makes the decisions to regulate prices and wages, production quotas, and the distribution of raw materials

Trickle Up (Demand Side Economics)

- Demand-side economics refer to Keynesian economists' belief that demand for goods and services drive economic activity.

- A core characteristic of demand-side economics is aggregate demand.

- Government can generate demand for goods and services if people and businesses are unable to.

- Putting more money in the pockets of the middle and lower classes has a greater benefit to the economy than saving or stockpiling the money in a wealthy person's account. (Taxing corporations and the rich instead of the middle and lower classes)

Free Trade Agreements

- Nationalistic political parties support protectionism, which enables the government to promote domestic producers, which would allow the domestic production of goods and services to increase. It also allows the government to shield developed foreign competitors from emerging domestic industries, which is compatible with the communist ideology.

- Far left groups oppose free trade based on their assertion that free-trade agreements generally do not increase the economic freedom of the poor or of the working class and frequently make them poorer.

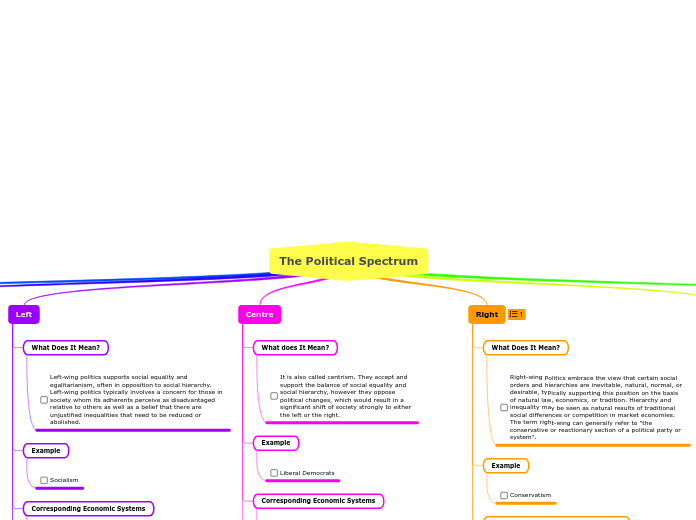

Left

What Does It Mean?

Left-wing politics supports social equality and egalitarianism, often in opposition to social hierarchy. Left-wing politics typically involves a concern for those in society whom its adherents perceive as disadvantaged relative to others as well as a belief that there are unjustified inequalities that need to be reduced or abolished.

Example

Socialism

Corresponding Economic Systems

Command Economies:

- The government regulates the amount, distribution, and price of goods and services

- The govt restricts and controls the ownership of private property

- More government control means that the profit motive is not the overriding goal of the business

- The needs of the entire society are considered before the individual’s needs

- The state makes the decisions to regulate prices and wages, production quotas, and the distribution of raw materials

Trickle Up (Demand Side Economics)

- Demand-side economics refer to Keynesian economists' belief that demand for goods and services drive economic activity.

- A core characteristic of demand-side economics is aggregate demand.

- Government can generate demand for goods and services if people and businesses are unable to.

- Putting more money in the pockets of the middle and lower classes has a greater benefit to the economy than saving or stockpiling the money in a wealthy person's account. (Taxing corporations and the rich instead of the middle and lower classes)

Free Trade Agreements

- Parties of the left in government in adopt protectionist policies for ideological reasons and because they wish to save worker jobs.

- Left-wing governments are considered more likely than others to intervene in the economy and to enact protectionist trade policies.

- The left favours protectionism to foster more employment. That's why they opppose free trade agreement because they outsource jobs, which leads to unemployment.

- Socialists frequently oppose free trade on the ground that it allows maximum exploitation of workers by capital.

Centre

What does It Mean?

It is also called centrism. They accept and

support the balance of social equality and

social hierarchy, however they oppose

political changes, which would result in a

significant shift of society strongly to either

the left or the right.

Example

Liberal Democrats

Corresponding Economic Systems

Mixed Economy:

- Mixed economies combines government involvement and private ownership of businesses

- Mixed economies have aspects of both market and centrally planned economic systems

- In socialist mixed economies, most of the main industries are government-controlled

Free Trade Agreement

- The centrists support free trade agreement because they believe that with free trade agreements there is an increase in the economic growth, there is lower government spending, there is a technology transfer that is going on, low duty free access and other benefits, including, stronger intellectual property protection.

- Free trade allows companies from rich countries to directly invest in poor countries, sharing their knowledge, providing capital and giving access to markets.

Right

What Does It Mean?

Right-wing politics embrace the view that certain social orders and hierarchies are inevitable, natural, normal, or desirable, typically supporting this position on the basis of natural law, economics, or tradition. Hierarchy and inequality may be seen as natural results of traditional social differences or competition in market economies. The term right-wing can generally refer to "the conservative or reactionary section of a political party or system".

Example

Conservatism

Trickle Down (Supply Side Economics)

- Supply-side economics or trickle down economics is an economic theory that postulates tax cuts for the wealthy and on businesses result in increased savings and stimulate investment capacity for them in the short term that trickle down to the overall economy and benefit society at large in the long term.

- A basis of supply-side economics is The Laffer Curve. It is a theory developed by supply-side economist Arthur Laffer to show the relationship between tax rates and the amount of tax revenue collected by governments. The curve is used to illustrate Laffer's argument that sometimes cutting tax rates can increase total tax revenue.

Free Trade Agreements

- Right-wing parties support free trade policies because the right wing came its origin from the capitalistic views and contribution to the free market economy that they share.

- Perception of government economic performance is seen as having the strongest effect on public support for free trade. Other indicators, of an individual’s potential to participate in the economy and profit as a consumer, are also positive and statistically significant. All else being equal, a more right-wing ideology is linked to greater support for free-trade agreements than a left-wing ideology. Moreover, the effect of political ideology on attitudes toward free trade is magnified at greater levels of political knowledge. Finally, the analysis suggests that macroeconomic conditions are related to mean levels of support for free-trade agreements.

Far Right

What Does It Mean?

Far-right politics, also referred to as the extreme right or right-wing extremism, are politics that are extremist nationalism, anti-communism, nativist ideologies and authoritarian tendencies. They have feature aspects of ultranationalist, chauvinist, xenophobic, theocratic, racist, homophobic, transphobic, or reactionary views.

Far-right politics can lead to oppression, political violence, forced assimilation, ethnic cleansing and even genocide against groups of people based on their supposed inferiority, or their perceived threat to the native ethnic group, nation, state, national religion, dominant culture, or ultraconservative traditional social institutions.

Example

Fascism

Corresponding Economic Systems

Market Economies:

- Ownership of private property is encouraged (including businesses)

- Businesses are encouraged to introduce new and better products

- Competition is encouraged to as a healthy and necessary element to create quality and lower prices

- Government have little direct involvement with businesses

- Foreign investment is encouraged and self sufficiency is not seen as an economic goal

- Prices are determined by the law of demand and supply

Trickle Down (Supply Side Economics)

- Supply-side economics or trickle down economics is an economic theory that postulates tax cuts for the wealthy and on businesses result in increased savings and stimulate investment capacity for them in the short term that trickle down to the overall economy and benefit society at large in the long term.

- A basis of supply-side economics is The Laffer Curve. It is a theory developed by supply-side economist Arthur Laffer to show the relationship between tax rates and the amount of tax revenue collected by governments. The curve is used to illustrate Laffer's argument that sometimes cutting tax rates can increase total tax revenue.

Free Trade Agreements

- Protectionism is a policy for far left, left, and far right.

- The far right favours them to increase profits.

- Domestic industries often oppose free trade because they think that it would lower prices for imported goods that would in result reduce their profits and market share. For example, if a country reduced tariffs on imported sugar, sugar producers would receive lower prices and profits, and sugar consumers would spend less for the same amount of sugar because of those same lower prices. Since each of the domestic sugar producers would lose a lot while each of a great number of consumers would gain only a little, domestic producers are more likely to mobilize against the reduction in tariffs. More generally, producers often favor domestic subsidies and tariffs on imports in their home countries while objecting to subsidies and tariffs in their export markets.

- Far right oppose free trade based on their assertion that free-trade agreements generally do not increase the economic freedom of the poor or of the working class and frequently make them poorer.

- Specifically, as inequality within countries increases, support for free-trade agreements decreases.

Capitalism (USA)

Medical Insurance - Maternity Leave

- In the United States paid maternity leave is almost unheard of. Only 13% of employers offer full benefits for paid maternity leave.

- In a study conducted in 2015 on American women who had babies and then returned to work, one in four women returned to their jobs less than two weeks after having their baby for fear of losing their job, whether healed or not, against the doctors advice, American women go right back to work after having a baby because there is no option. According to this same study, 40% of American families with children under the age of 18 rely heavily on the mother’s income.

- Furthermore, the reason that the mother has to go to work after birth less than 2 weeks is because the American government has no budget for helping these families and the American employers do not care to give them paid leave that they desperately need and deserve. - The United States only has the Family Medical Leave Act, which only applies if the parent have to have been at their job for at least a year, and even then it only allows twelve weeks of unpaid leave.

Unemployment Insurance Benefits & Supplements

- The duration of UI payments isn’t federally mandated so in a few states payments can run for as little as 14 weeks (12 fewer than the nationally recommended 26 weeks).

- After the 2008 financial crisis, the federal government passed emergency legislation incorporating an emergency unemployment compensation (EUC) element, which extended entitlement to unemployment benefits from 26 weeks to as much as 99.

- For the long-term unemployed (those out of work for 6 months+) the situation can be extremely challenging in the US if they don’t find work quickly. Some extremely poor families may receive cash benefits from a program called temporary cash assistance for needy families (TANF).

- There are two main benefits that disabled people can apply for, both of which are administered nationally by the social security administration. The is Social Security Disability Insurance, (SSDI) which is funded through worker and employer payroll contributions.

- According to the OECD, SSDI payments average $1,140 per month and are much less than the benefits paid by most other advanced nations. The US is also hovering towards the bottom of the league tables on the percentage of its GDP that goes on disability benefits (just 0.8% in 2009 compared to the UK’s 2.4% - before austerity and recent welfare reforms).

- Supplemental Security Income (SSI), the second type of disability benefit and which is designed to meet the basic needs of the poorest disabled people, is paid to just under 5 million working age people with around 1.3 million disabled children also receiving payments. On average, working age adults on SSI receive $525 per month and for most it is their only source of income. People who are paid disability benefits generally receive some public health insurance but eligibility criteria varies between states.

Corporate Taxes

In 2020, the corporate taxes for USA is 25.77%.

Gross Salary After Tax Tax Rate

€28 000 €22 548 19.5%

€45 000 €34 266 23.9%

€113 000 €74 463 34.1%

- In the USA, it’s up to your preference to contribute in social benefits or not.