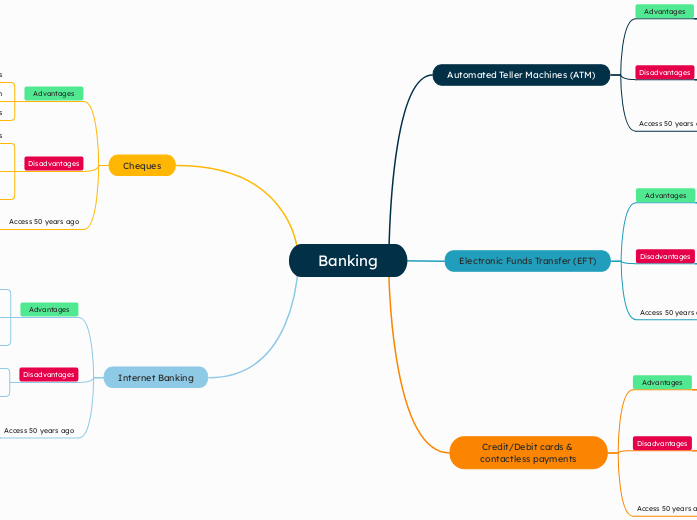

Banking

Automated Teller Machines (ATM)

Advantages

Accessible 24/7

Provides quick cash withdrawal

Reduces the need for in-bank transactions

Disadvantages

Vulnerable to fraud

Service fees may apply

Limited to certain types of transactions

Access 50 years ago

Teller at a bank branch during working hours

Withdrawal through cheques or bank drafts

Electronic Funds Transfer (EFT)

Advantages

Fast and secure transactions

No need for physical cash

Reduces processing time for payments

Disadvantages

Risk of cyber attacks

Possible transfer delays

Requires technical infrastructure

Access 50 years ago

Cash or cheque payments

Manual bank processing, often requiring several days

Credit/Debit cards & contactless payments

Advantages

Convenient for everyday purchases

Contactless is fast and hygenic

Reduces the need to carry cash

Disadvantages

Risk of over spending

Susceptible to fraud

Merchant fees can be high

Access 50 years ago

Cash payments

Charge accounts or layway plans with retailers

Traveler's cheques for larger purchases

Cheques

Advantages

Safe for larger payments

Provides a record of transaction

Accepted by many vendors

Disadvantages

Processing can take days

Risk of bounced cheques if funds are insufficient

Paper-based, so environmentally less friendly

Access 50 years ago

Cheques have been in use for decades, so similar process

Internet Banking

Advantages

24/7 access to account information

Ability to perform many banking activities remotely

Reduces the need for physical visits to banks

Disadvantages

Cybersecurity concerns

Can be difficult for users without reliable internet

Access 50 years ago

In person visits to bank branches

Telephone banking or postal transactions for some services