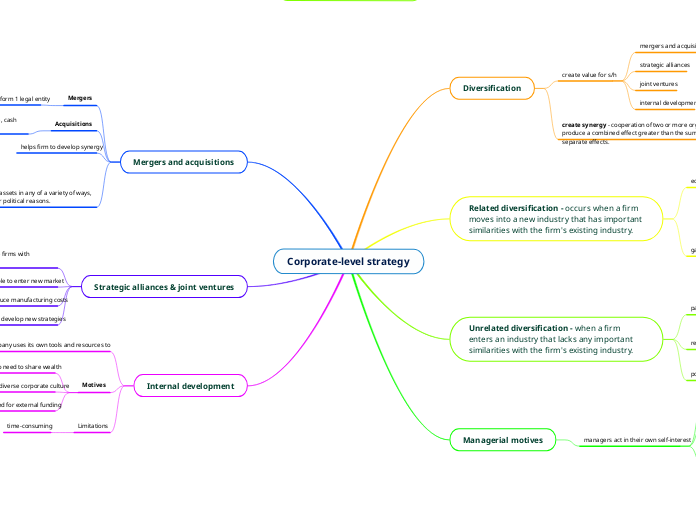

Corporate-level strategy

Diversification

create value for s/h

mergers and acquisitions

strategic alliances

joint ventures

internal development

create synergy - cooperation of two or more organizations to produce a combined effect greater than the sum of their separate effects.

Related diversification - occurs when a firm moves into a new industry that has important similarities with the firm's existing industry.

economies of scope

leverage core competencies

share related activities

enhance differentiation

gain market power by

pooled negotiating power - gaining greater bargaining power with suppliers and customers

vertical integration - becoming its own supplier/distributor

backward integration

forward integration

Unrelated diversification - when a firm enters an industry that lacks any important similarities with the firm's existing industry.

parenting

create value through management expertise and competent central functions

restructuring

redistribute assets & capital

management restructuring

portfolio management

Boston Consulting Group's (BCG) growth

Managerial motives

managers act in their own self-interest

growth for growth's sake

excessive egotism

use of antitakeover tactics

green mail

golden parachutes

poison pills

Mergers and acquisitions

Mergers

combination of 2 firms to form 1 legal entity

Acquisitions

one firm buying another either through stock purchase, cash or issuance of debt

helps firm to develop synergy

Divestment - the disposal of assets in any of a variety of ways, usually for ethical, financial, or political reasons.

objectives

cutting financial losses

raising cash to help fund existing business

redirecting focus on the firm's core business

freeing up resources to spend on more attractive alternatives

Strategic alliances & joint ventures

cooperative relationship between 2 or more firms with potential advantage

able to enter new market

able to reduce manufacturing costs

able to develop new strategies

Internal development

occurs when a company uses its own tools and resources to expand

Motives

no need to share wealth

no need to merge diverse corporate culture

no need for external funding

Limitations

time-consuming