Financial Analysis

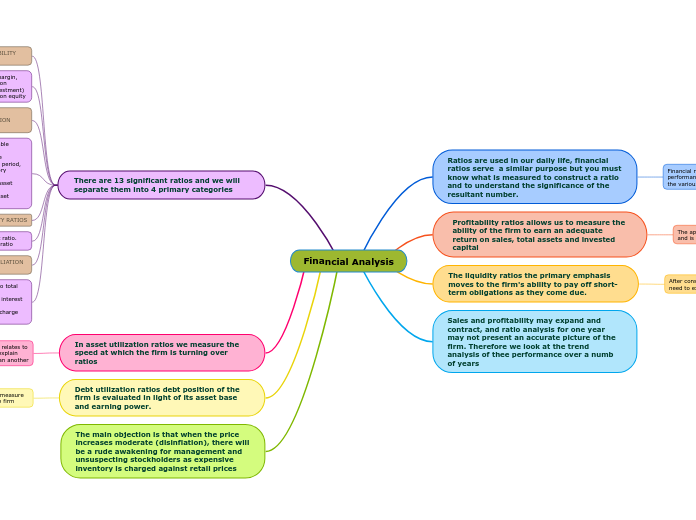

Ratios are used in our daily life, financial ratios serve a similar purpose but you must know what is measured to construct a ratio and to understand the significance of the resultant number.

Financial ratios are used to weigh and evaluate the operating performance of the firm. Ratios are also important to people in the various functional areas of a business.

Profitability ratios allows us to measure the ability of the firm to earn an adequate return on sales, total assets and invested capital

The appropriate ratio is computed for the Saxton Company and is then compared to representative industry data

The liquidity ratios the primary emphasis moves to the firm's ability to pay off short-term obligations as they come due.

After considering profitability and asset utilization the analyst need to examine the liquidity of the firm.

Sales and profitability may expand and contract, and ratio analysis for one year may not present an accurate picture of the firm. Therefore we look at the trend analysis of thee performance over a numb of years

There are 13 significant ratios and we will separate them into 4 primary categories

PROFITABILITY RATIOS

1.Profit margin, 2.Return on asset(investment) 3.Return on equity

ASSET UTILIZATION RATIOS

4.Receivable turnover, 5.Average collection period, 6.Inventory turnover 7. Fixed asset turnover. 8.Total asset turnover

LIQUIDITY RATIOS

9.Current ratio. 10.Quick ratio

DEBT UTILIATION RATIOS

11.Debt to total assets. 12.Times interest earned. 13.Fixed charge coverage

In asset utilization ratios we measure the speed at which the firm is turning over ratios

Asset utilization ratios, the second category of ratios relates to asset utilization and the ratios in this category may explain why one firm can turn over its asset more rapidly than another

Debt utilization ratios debt position of the firm is evaluated in light of its asset base and earning power.

The last group debt utilization, allows the analyst to measure the prudence of the debt management policies of the firm