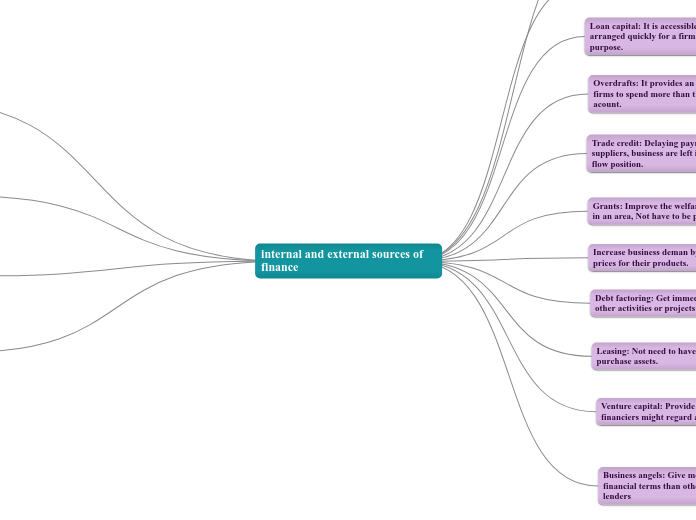

internal and external sources of finance

Internal sources of finance

Personal funds: Sole tradersmaximize their control over the business. It is a preferred source of finance.

Retained profit: It is cheap because it does not incur interest charges.

Sale of assets: Selling assets is that it is good way of raising cash.

External sources of finance

Share capital: Entitled to dividends when profits are made.

Loan capital: It is accessible and can be arranged quickly for a firm's specific purpose.

Overdrafts: It provides an opportunity for firms to spend more than they have in their acount.

Trade credit: Delaying payments to suppliers, business are left in a better cash-flow position.

Grants: Improve the welfare of people living in an area, Not have to be paid.

Increase business deman by charging lower prices for their products.

Debt factoring: Get immediate cash to fund other activities or projects

Leasing: Not need to have a high capital to purchase assets.

Venture capital: Provide funding that other financiers might regard as too high a risky.

Business angels: Give more favourable financial terms than other institutions or lenders