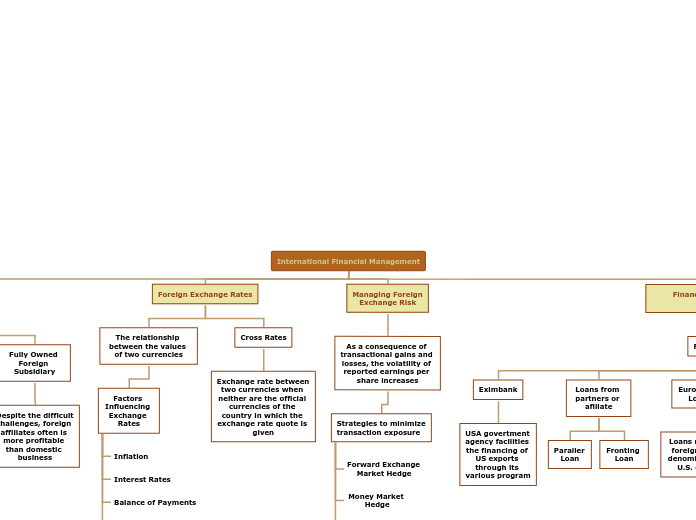

International Financial Management

The Multinational Corporation: Nature and Corporation

Exporter

The least risky method, recaping the benefits of foreign demand without committing any long term investment to that foreign country

Licensing Agreement

The exporting firm may grant a license to an independent local producer to use the firm’s technology in return for a license fee or a royalty

Joint Venture

A joint venture with a local entrepreneur exposes the firm to the least amount of political risk

Fully Owned Foreign Subsidiary

Despite the difficult challenges, foreign affiliates often is more profitable than domestic business

Foreign Exchange Rates

The relationship between the values of two currencies

Factors Influencing Exchange Rates

Inflation

Interest Rates

Balance of Payments

Government Policies

Cross Rates

Exchange rate between two currencies when neither are the official currencies of the country in which the exchange rate quote is given

Managing Foreign Exchange Risk

As a consequence of transactional gains and losses, the volatility of reported earnings per share increases

Strategies to minimize transaction exposure

Forward Exchange Market Hedge

Money Market Hedge

Currency Futures Market Hedge

Financing International Business Operations

Funding of Transaction

Eximbank

USA govertment agency facilities the financing of US exports through its various program

Loans from partners or afiliate

Paraller Loan

Fronting Loan

Eurodollar Loans

Loans made by foreign banks denominated in U.S. dollars

Eurobond Market

Bonds payable or denominated in the borrower’s currency sold outside the country of the borrower

Internationally Equity Markets

The entire amount of equity capital comes from the parent company for a wholly owned foreign subsidiary

The International Finance Corporation

An affiliate of the World Bank established with the sole purpose of providing partial seed capital for private ventures around the world