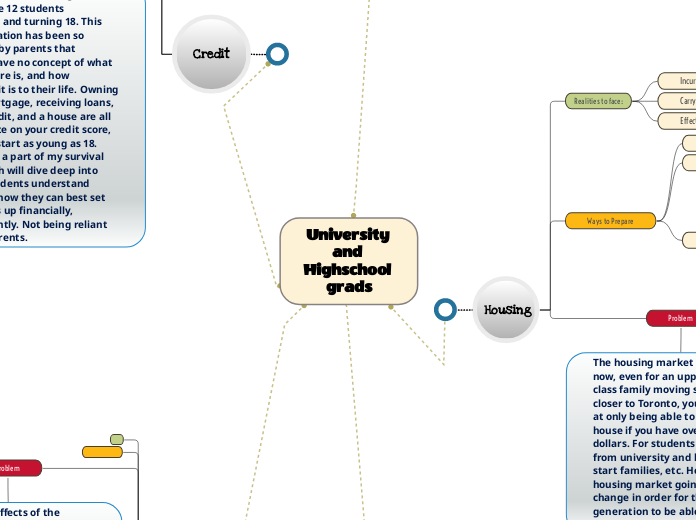

University and Highschool grads

Investing

Importance

Who cares where i put my money?

Steps

TFSA, Savings, Banking

Understanding the Markets and key factors

Budgeting and Planning

What products are high in elasticity and demand in your life?

Problem:

So many teens are entering the world with not much to their name. The world of investing has grown so large and broad that many have no idea what to do with their money. Just listening to their parents and using their stock broker is not the right way to prepare for your own future. So what does this look like? Learning the stock market, different savings accounts, and important saving practices are going to a long way to ensure you have the money you need, when you need it. (which is not now).

Housing

Realities to face:

Incurring Debt

Carrying a Mortgage

Effects of Inflation

Ways to Prepare

Credit (see credit subtopic)

Saving (see investing subtopic)

Where to live?

Probably not Toronto, or anywhere in the GTA for that matter. Does this change what you may want to do for a living? Or what may you have to change about your life in order to afford the city/suburb life.

Problem

The housing market is insane right now, even for an upper-middle class family moving somewhat closer to Toronto, you are looking at only being able to purchase a house if you have over a million dollars. For students carrying debt from university and looking to start families, etc. How is the housing market going to have to change in order for the next generation to be able to afford a small one-two bedroom house?

Jobs

What to research

Competetive job feilds

Desired trades and skills

Subtopic

Ability for promotion

Problem

So many teens are coming out of

high school wishing to be nurses, teachers, golf managers (true story) without the proper knowledge of how competitive these fields can be. Nursing is now one of the hardest things to get into in Ontario, as well as a Con-ed program for teaching. Years ago, there was such a surplus in teachers that many were stuck on the supply line for years. Nursing used to be quite an easy program for young students, however now everyone wants to be a nurse and it has become a very congested field. Engineers and Tech jobs are desperate for new employees... so what can we do to push students in the right direction?

Credit

Why do I need to worry about my credit score?

Ability to own a house, car and have a mortgage

Ability to recieve lines of credit and credit cards

How can i build strong credit?

Begin paying your own bills at 18

Maintain responsible payment habits

This looks like:

Problem

The idea of credit is foreign for many grade 12 students graduating and turning 18. This new generation has been so supported by parents that students have no concept of what a credit score is, and how important it is to their life. Owning a car, a mortgage, receiving loans, lines of credit, and a house are all determinate on your credit score, which can start as young as 18. This will be a part of my survival guide which will dive deep into helping students understand credit and how they can best set themselves up financially, independently. Not being reliant on their parents.

COVID-19

Problem

The long-term effects of the pandemic on the university and high school generation is magnificent. the economy effects of global trade, imports/exports, supply, and demand for certain products has drastically changed in the past 2 years. Some factors have significantly changed for the better, but there are many factors of the economy that may take up to a decade until it can get back to how it used to be.