作者:Lorenzo Covre 1 年以前

195

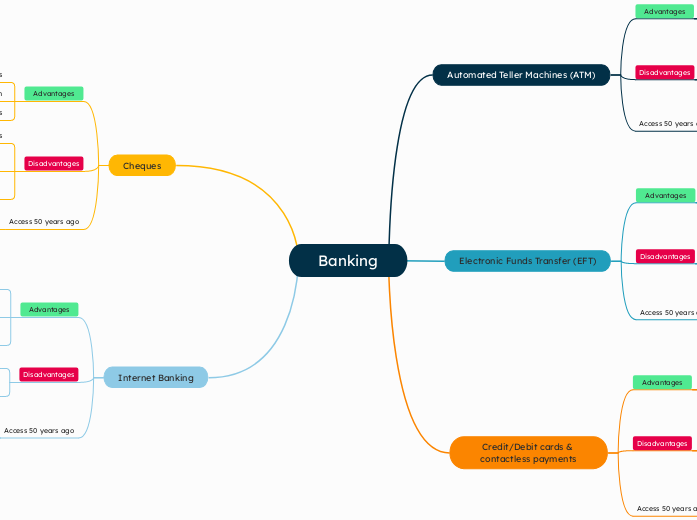

Banking

Banking

Internet Banking

Telephone banking or postal transactions for some services

In person visits to bank branches

Can be difficult for users without reliable internet

Cybersecurity concerns

Reduces the need for physical visits to banks

Ability to perform many banking activities remotely

24/7 access to account information

Cheques

Cheques have been in use for decades, so similar process

Paper-based, so environmentally less friendly

Risk of bounced cheques if funds are insufficient

Processing can take days

Accepted by many vendors

Provides a record of transaction

Safe for larger payments

Credit/Debit cards & contactless payments

Traveler's cheques for larger purchases

Charge accounts or layway plans with retailers

Cash payments

Merchant fees can be high

Susceptible to fraud

Risk of over spending

Reduces the need to carry cash

Contactless is fast and hygenic

Convenient for everyday purchases

Electronic Funds Transfer (EFT)

Manual bank processing, often requiring several days

Cash or cheque payments

Requires technical infrastructure

Possible transfer delays

Risk of cyber attacks

Reduces processing time for payments

No need for physical cash

Fast and secure transactions

Automated Teller Machines (ATM)

Access 50 years ago

Withdrawal through cheques or bank drafts

Teller at a bank branch during working hours

Disadvantages

Limited to certain types of transactions

Service fees may apply

Vulnerable to fraud

Advantages

Reduces the need for in-bank transactions

Provides quick cash withdrawal

Accessible 24/7