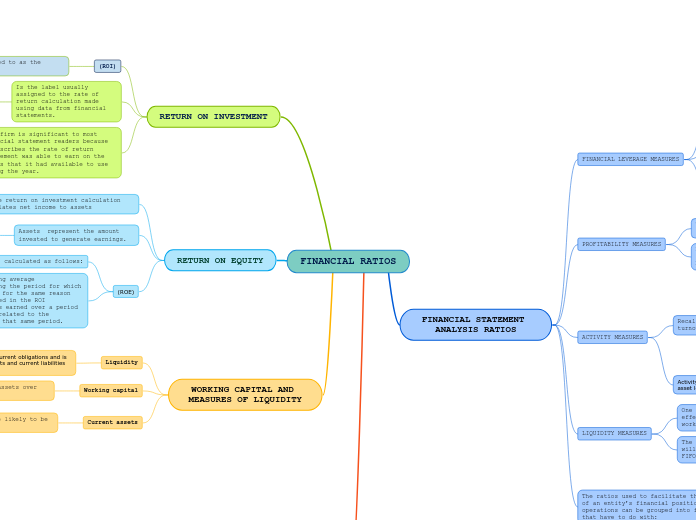

FINANCIAL RATIOS

WORKING CAPITAL AND MEASURES OF LIQUIDITY

Current assets

Are cash and other assets that are likely to be converted to cash within a year

Principally accounts receivable and merchandise inventories

Working capital

Is the excess of a firm’s current assets over its current liabilities.

Liquidity

Refers to a firm’s ability to meet its current obligations and is measured by relating its current assets and current liabilities as reported on the balance sheet.

RETURN ON EQUITY

(ROE)

Usually is calculated using average stockholders’ equity during the period for which the net income was earned for the same reason that average assets is used in the ROI calculation; net income is earned over a period of time, so it should be related to the stockholders’ equity over that same period.

It is calculated as follows:

Net Income/Average stockholder´s equity

Assets represent the amount invested to generate earnings.

Perhaps adjusted to exclude nonoperating assets or other items.

The return on investment calculation relates net income to assets

Perhaps adjusted for interest, income taxes, or other items.

RETURN ON INVESTMENT

Of a firm is significant to most financial statement readers because it describes the rate of return management was able to earn on the assets that it had available to use during the year.

Is the label usually assigned to the rate of return calculation made using data from financial statements.

There are many ways of defining both the amount of return and the amount invested.

(ROI)

This ratio is sometimes referred to as the return on assets (ROA).

ACID-TEST RATIO

Is a more conservative short-term measure of liquidity because merchandise inventories are excluded from the computation.

This ratio provides information about an almost worst-case situation—the firm’s ability to

meet its current obligations even if none of the inventory can be sold.

“Also known as the quick ratio”

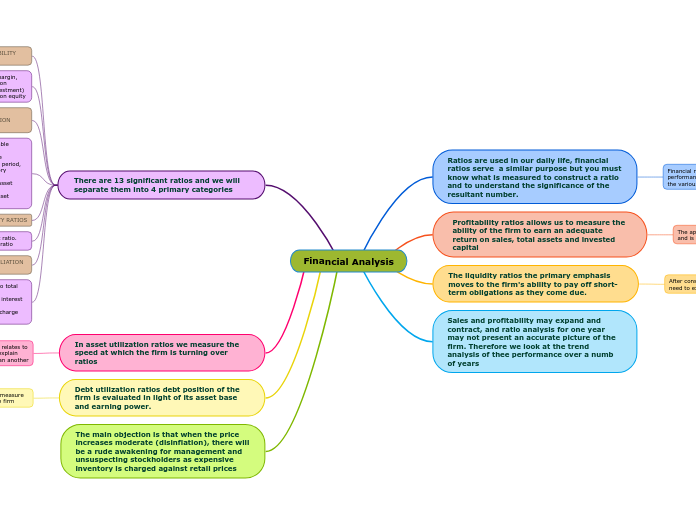

FINANCIAL STATEMENT ANALYSIS RATIOS

The ratios used to facilitate the interpretation of an entity’s financial position and results of operations can be grouped into four categories that have to do with:

4. Debt or financial leverage.

3. Profitability.

2. Activity.

1. Liquidity.

LIQUIDITY MEASURES

The balance sheet carrying value of inventories will depend on whether the weighted-average, FIFO, or LIFO assumption is used.

One point that deserves reemphasis is the effect of the inventory cost flow assumption on working capital. Subtopic

ACTIVITY MEASURES

Activity measures focus primarily on the relationship between asset levels and sales (i.e., turnover).

Recall that the general model for calculating turnover is:

Turnover = Sales / Average assets

Turnover is frequently calculated for:

Total assets.

Total operating assets.

Plant and equipment

Inventories.

Accounts receivable.

PROFITABILITY MEASURES

Each of these measures relates net income, or an income statement subtotal, to an element of the balance sheet.

E.g., operating income

The significant measures of profitability, return on investment and return on equity.

FINANCIAL LEVERAGE MEASURES

The most nonfinancial firms try to limit the debt in their capital structure to no more than 50 percent of total capital (debt plus stockholders’ equity).

Two financial leverage measures, the debt ratio and the debt/equity ratio, are used to indicate the extent to which a firm is using financial leverage.

Leverage adds risk to the operation of the firm because if the firm does not generate enough cash to pay principal and interest payments, creditors may force the firm into bankruptcy.

Financial leverage refers to the use of debt to finance the assets of the entity.