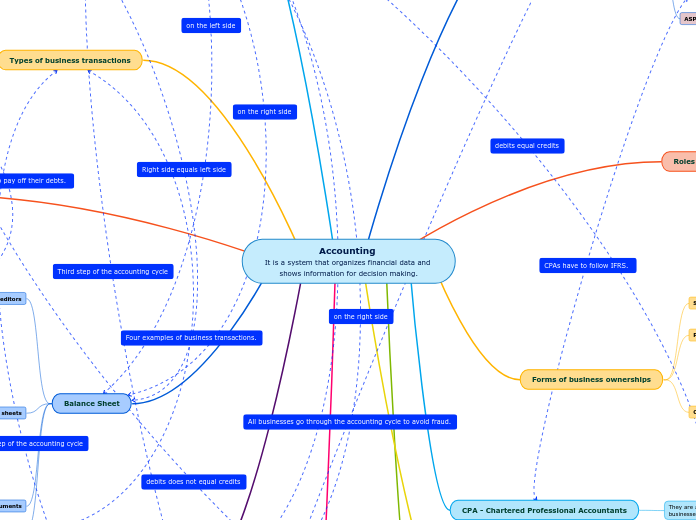

Accounting

It is a system that organizes financial data and shows information for decision making.

Types of businesses

Service Business

The business does not sell products but they assist customers or does a service. For example, a hospital is a service business because they mainly treat patients and they aren't known for selling products.

Manufacturing Business

The business makes their own products and sells them. For example, Honda is a manufacturing business because they create their own models of cars and they sell them.

Merchandising Business

The business does not make their own products but they buy products from manufacturing businesses and resell the products for a higher price. For example, Best Buy is a merchandising business because they get products from other companies and resells them.

Not-For-Profit Organizations

Not-For-Profit Organizations are organizations that do charity work or help out for certain things and are not doing it for money or for profit. For example, Red Cross is a not-for-profit organization because they are helping people but they aren't making a profit.

AcSB

The Accounting Standards Board establishes standards for use by Canadian entities outside the public sector (like private enterprises).

IASB

The International Accounting Standards Board is an organization that develops and approves IFRS for the private sector.

IFRS

The International Financial Reporting Standards are a group of accounting standards that have to be followed by businesses.

ASPE

The Accounting Standards for Private Enterprises are accounting principles for small-medium sized enterprises that do not have to report their financial data to the public.

Roles in accounting

Bookkeeper

They in charge of the general ledger. They record all transactions, post costs and income, make payroll calculations, prepares payroll cheques, and other payroll records.

Auditor

They are in charge of reviewing the company's financial statements, documents, data, and accounting entries.

Controller

They are in charge of reporting material budgeting variances or expenditure variances to management.

CFO - Chief Financial Officer

They are in charge of cash flow, financial planning, analyzing the company's financial strengths and weaknesses, and proposing corrective actions.

Tax accountant

They are in charge of keeping their clients updated on their return information, and working with them before tax time to get a plan that will help them reach their desired financial goals.

Forensic accountant

They are in charge of compiling financial evidence, developing computer applications, managing the information collected, and communicating their findings in form of reports or presentations.

Forms of business ownerships

Sole proprietorship

These types of companies are owned by one person.

For example: lemonade stands.

Partnership

These types of companies are owned by two or more individuals and their responsibilities are split equally.

For example: online clothing business.

General Partnernship

Limited Partnership

Corporation

These types of companies have parts of the the ownership sold to the public (stocks or shares) and the owners are called shareholders.

For example: Apple.

Private Corporations

They are not listed for sale on stock exchanges and only a few people can own the business.

Public Corporations

They are listed for sale to the public and anyone can buy them.

Crown Corporations

They are owned by provincial or federal governments.

Municipal Corporations

They provide services for local citizens.

CPA - Chartered Professional Accountants

They are a trusted financial advisor who help individuals or businesses to reach their financial goals.

Trial balance

A list of ledger accounts that calculates the sum of the assets, liabilities, and owner's equity.

In balance

if the total amount of debit balances equal to the total of credit balances

Out of balance

if the total amount of debit balances equals to the total of credit balances

Main topic

Ledger

T-accounts

Debit

on the left side

Credit

on the right side

Double-entry system of accounting

Whenever a transaction is made, two or more accounts are affected. Therefore, the total amount of debit amounts equal to the total amount of credit amounts.

Exceptional account balances

Usually the debit equals the credit but at times it has a balance opposite where the debit does not equal the credit and it doesn't mean a mistake was made.

Types of business transactions

Purchase on account

The purchased item or thing was not paid for at the time.

For example: Eric bought a building for $50,000 from Belleville Real Estate on account.

Sale on account

The item that was sold was not paid for at the time.

For example: Kristin provided a $200 service for a customer on account.

Payment on account

Money is paid to creditor to reduce the amount owed.

For example: Jennifer paid $550 on account to reduce the amount of her mortgage.

Receipt on accountundefined

Money is received from the debtor to reduce the amount owed.

For example: Food Co. pays off the amount of $120 owed to Sunfood Supermarket on account.

GAAP

Generally Accepted Accounting Principles

Business Entity Concept

A long-standing principle that states that all personal affairs should be separate from the business' affairs.

The Cost Principle

All assets and liabilities that have value in the business have to be recorded.

Continuing Concern Principle

It is assumed that the business will keep running unless stated that it is not operating anymore.

Objectivity Principle

There has to be a clear, verifiable document proving that the transaction is real. If the transaction cannot be proven, then it will not be recorded.

Balance Sheet

Debtors and Creditors

Accounts receivable (debtors)

They are accounts for customers who purchased products but have not paid the company yet. The people who owe money to the company are debtors.

Accounts payable (creditors)

They are accounts for the companies that the business purchased from and still have to pay them back. The people who are owed money to are creditors.

Formats for balance sheets

Classified balance sheet

current assets and then long-term assets

Current assets - cash or assets that are converted to cash within a year or can be used up in a year. For example: bank or accounts receivable.

Long-term assets - items that last longer than a year. For example: equipment, buildings, or lands.

current liabilities and then long-term liabilities and then equity

Current liabilities - things that are due in a year. For example: account payables.

Long-term liabilities - things that take more than a year to pay off. For example: heavy bank loans or mortgages.

Statement of financial position

long-term assets and then current assets

equity and then long-term liabilities and then current liabilities

Source documents

The original copy of the transactions or proof of the transactions on the balance sheet.

Business transactions

Actions that cause a change in the assets, liabilities or in the owner's equity.

Financial Positions

Assets

Anything that has an economic value owned by the business.

Liabilities

Any debts that effect the economic of the business owed by the business.

Owner's Equity

The amount of money between the assets and what they owe.

Fundamental accounting equation

Assets = Liabilities + Owner's Equity