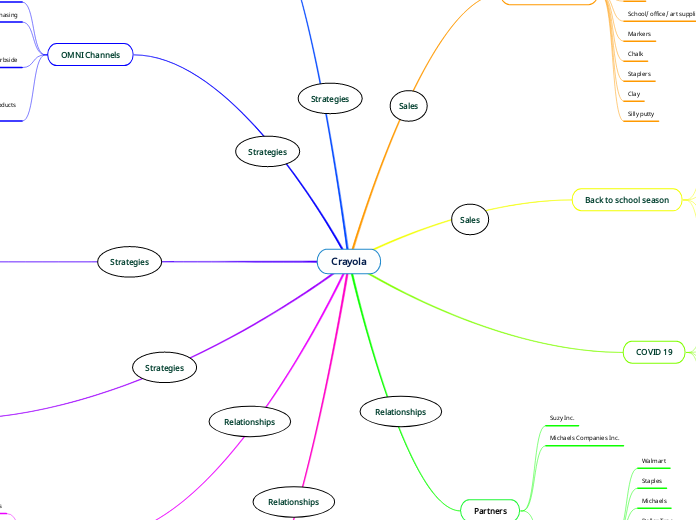

Crayola

Services/ Products

Crayons

Producer's of 80-90% of worlds crayons

Creative toys

Craft activities

Art tools

Crayola experience

5 Locations

Pencils

Pens

School/ office/ art supplies

Markers

Chalk

Staplers

Clay

Silly putty

Back to school season

Busy season

Embrace tech

Late June to mid September

30% of market study parents had standard list

of school supplies they purchased every year (2020-21)

COVID 19

Growth in activity based toys

44% of market study parents delayed purchases

as of mid august 2020

Shift in purchasing of physical supplies

Deloitte survey found 40% of parents planned to

to buy fewer traditional school supplies in fall 2020

Partners

Suzy Inc.

Michaels Companies Inc.

Mass merchandisers

Walmart

Staples

Michaels

Dollar Tree

Canadian Tire

Mastermind Toys

Target

The Kroger Company

bundle product kits

Potential Markets

NFT's

Candles

Make up and beauty products

Metaverse

Retail stores

OMNI Channels

Online shopping

In store purchasing

Buy online/ pick up at curbside

Adobe Inc Survey of 1000 consumers

Adobe Inc reported BOPIS orders maintained a year over

year growth of 195% in May 2020 and by 130% year over year in June 2020

23% of online shoppers preferred buying online and

picking up items in store rather then delivery

allows customers to buy and receive products

wherever and whenever they want

Marketing

Connecting product to customer emotionally and physically

Keep kids and families entertained

awareness for alternative uses for products

enhance brand loyalty

do it yourself project videos

Generate sales

Crayola mobile app

E commerce growth

Missions

Childhood development

Unleash originality

Help teachers and parents

Ways to cope, communicate, and connect

Inspire creativity

Entertain

Experience color

Customers

Parents

Kids

Teachers

Artists

Competitors

Sargent Art

ACCO Brands Corp.

AT Cross Co. LLC

Dixon Ticonderoga Co.

Pentel Co. LTD.