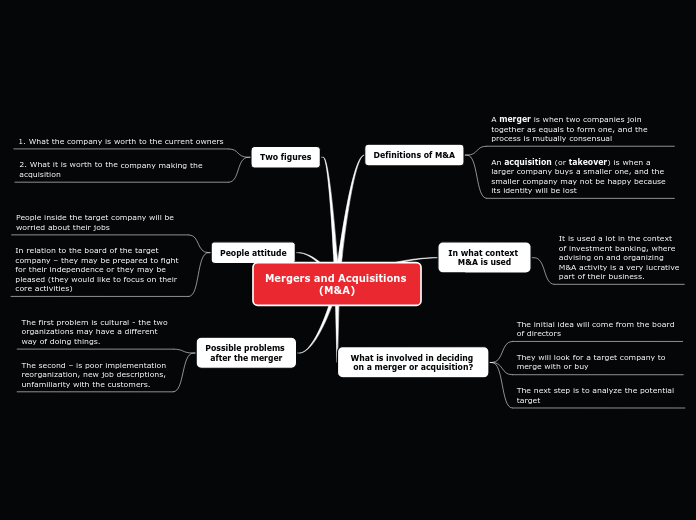

Mergers and Acquisitions (M&A)

Definitions of M&A

A merger is when two companies join together as equals to form one, and the process is mutually consensual

An acquisition (or takeover) is when a larger company buys a smaller one, and the smaller company may not be hаppy because its identity will be lost

In what context M&A is used

It is used a lot in the context of investment banking, where advising on and organizing M&A activity is a very lucrative part of their business.

What is involved in deciding on a merger or acquisition?

The initial idea will come from the board of directors

They will look for a target company to merge with or buy

The next step is to analyze the potential target

Two figures

1. What the company is worth to the current owners

2. What it is worth to the company making the acquisition

People attitude

People inside the target company will be worried about their jobs

In relation to the board of the target company – they may be prepared to fight for their independence or they may be pleased (they would like to focus on their core activities)

Possible problems after the merger

The first problem is cultural - the two organizations may have a different way of doing things.

The second – is poor implementation reorganization, new job descriptions, unfamiliarity with the customers.