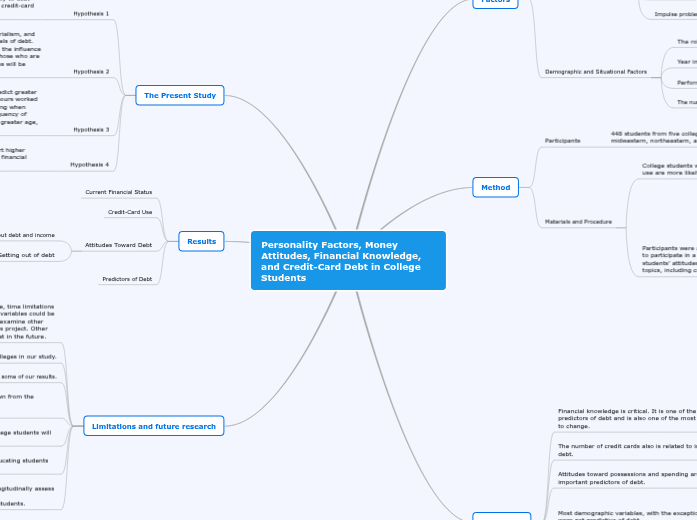

Personality Factors, Money Attitudes, Financial Knowledge, and Credit-Card Debt in College Students

Factors

Financial Knowledge and Attitudes

High school seniors know little about finances.

College students may not know much more, but hey have a degree of self-awareness about their lack of knowledge.

Possession of a credit card may facilitate spending among students, regardless of debt-tolerant attitudes.

Personality Characteristics

Locus of control in debt

Self-esteem

Impulse problems

Demographic and Situational Factors

The role of gender in debt

Year in college

Performance in school

The number of credit cards held and the frequency of use

Method

Participants

448 students from five colleges in three states in the midwestern, northeastern, and southern United States.

Materials and Procedure

College students with more liberal attitudes toward credit use are more likely to be in debt.

Participants were approached in their classes and asked to participate in a cross-campus research study of college students’ attitudes and beliefs on a number of personal topics, including credit cards and credit-card debt.

Financial status and credit-card use

The Financial Well-Being Scale

The Credit Card Use Scale

Attitudes toward debt

Financial knowledge

Psychological measures

The stress subscale of the Depression Anxiety

Stress Scale

The Brief Sensation-Seeking Scale

The Delay of Gratification Scale

The Materialism Scale

The Compulsive Buying Scale

Discussion

Financial knowledge is critical. It is one of the strongest predictors of debt and is also one of the most amenable to change.

The number of credit cards also is related to increases in debt.

Attitudes toward possessions and spending are also important predictors of debt.

Most demographic variables, with the exception of age, were not predictive of debt.

Age is a logical predictor.

Number of hours worked each week and GPA were not significant predictors.

The role of gender remains unclear.

As a group, students expected that they would earn more and pay off debt more quickly than the average person.

Future income is clearly important.

The Present Study

Hypothesis 1

Financial knowledge will be related negatively to debt and that tolerant attitudes toward debt and credit-card use will be related positively to debt.

Hypothesis 2

Higher levels of compulsive spending, materialism, and delay of gratification will predict greater levels of debt. Although no previous studies have reported the influence

of sensation seeking, we hypothesize that those who are easily bored and who seek novel experiences will be more likely to acquire debt.

Hypothesis 3

The following demographic variables will predict greater debt: larger number of credit cards, more hours worked

each week (to pay off debt), greater spending when students go out on weekends, reported frequency of credit-card use, lower grade point average, greater age, and later year in school.

Hypothesis 4

Those who report greater debt also will report higher levels of stress and lower levels of perceived financial well-being.

Results

Current Financial Status

Credit-Card Use

Attitudes Toward Debt

Beliefs about debt and income

Getting out of debt

Predictors of Debt

Limitations and future research

Although designed to be comprehensive, time limitations dictated that not all potentially related variables could be included. Future research may wish to examine other personality factors not addressed in this project. Other financial variables also will be of interest in the future.

We did not have a broad range of colleges in our study.

social desirability may have affected some of our results.

There are implications that can be drawn from the current

study.

The issue of consumer debt among college students will not be solved through current policies.

At present, there is no standard for educating students about money.

Future research should develop and longitudinally assess the efficacy of

financial literacy programs for college students.