af Andrea Melendez Rodriguez 4 år siden

469

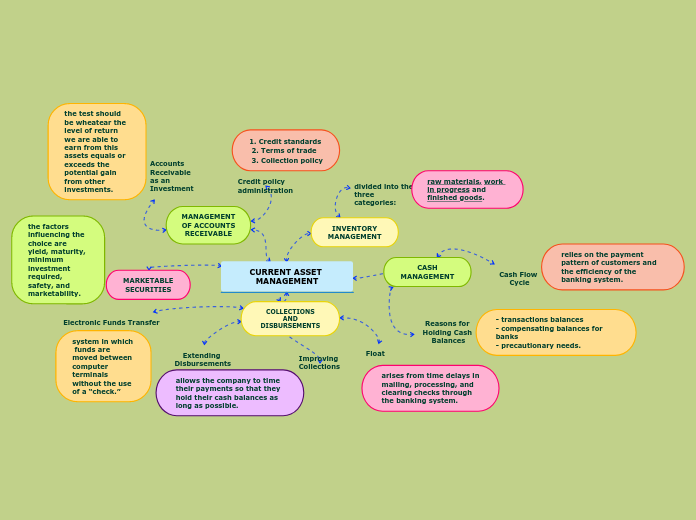

CURRENT ASSET MANAGEMENT

Evaluating the potential return from various assets is crucial for effective investment decisions, ensuring that the returns meet or exceed those from other opportunities. Efficient management of collections and disbursements is essential, involving a robust credit policy and leveraging systems like electronic funds transfer to streamline processes without using checks.