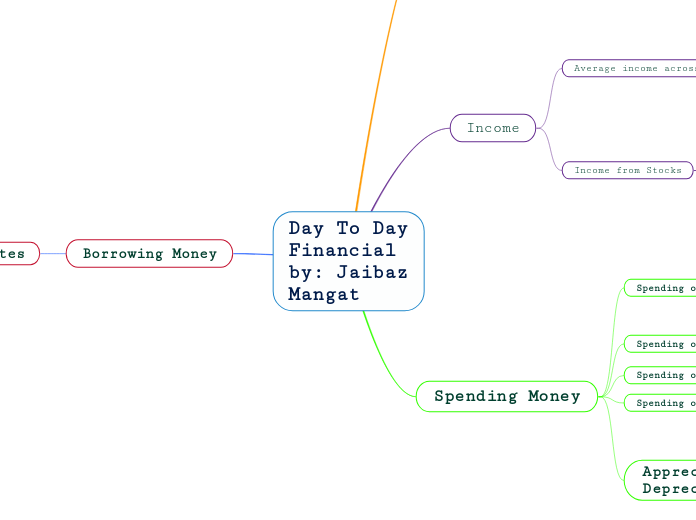

Day To Day Financial by: Jaibaz Mangat

Borrowing Money

Interest Rates

Loan Rates:4%

Mortgage rates: 6%

Credit Card;20%

Spending Money

Appreciation & Depreciation

All item depreciate once they are used, a $100,000 car can depreciate to $80,000 once used for 2 years as it has kilometers driven on the engine

When the economy is in a recession state the prices to purchase are higher than income which makes a reset in the economy

From 1990 to 2021 the Canadian dollar compared to US dollar has changed from $0.75 to $1 to $0.5

Spending on Luxuries

An average Canadian spends $5000 a year on vacations and luxuries

Spending on Food

The average Canadian spends $300 on groceries

Spending on Houses

An Average house in Canada has risen to $820,000 with a 3$ mortgage interest rate with 20% down payment

Spending on Cars

The average Canadian spends around $8000 a year on gas if they fill up once a week

The average Canadian spends $1300 a month on an average Canadian car of $40,000

Income

Income from Stocks

You can buy,hold and sell stocks. With the right education about stocks you can know when to sell and

According to researchers, an average Canadian has a 10% return on long-term stocks, as the average Canadian invests $5,000 yearly the return is $500

According to Stats Canada 41% of Canadians don't own stocks

Average income across Canada

According to Stats Canada in 2019, the average Canadian household spent $68,980 yearly on expenses

In 2020 the government of Canada recorded that an average family in Canada made around $55,700 which was a 3.3% decrease from the year before

Investing Money

Today's Interest Rates

Interest rates in savings accounts

Smaller banks around Canada can have higher rates at 1% to 2% for lower amounts of money

Interest rates in bigger banks across Canada range from 0.1% to 0.75% with a balance of $10,000 or more

Where you can Invest

Rental properties

Cryptocurrency

Stocks

Dividend stocks

Land & Property

Savings account

Interest terms & Types

Simple Interest:Interest that is calculated on the principal amount each term

Compound Interest:Interest that is calculated on the previous amount of interest earned

Principal Amount: The amount of money you start with/money you are investing with.