af Darina Hurtado 5 år siden

523

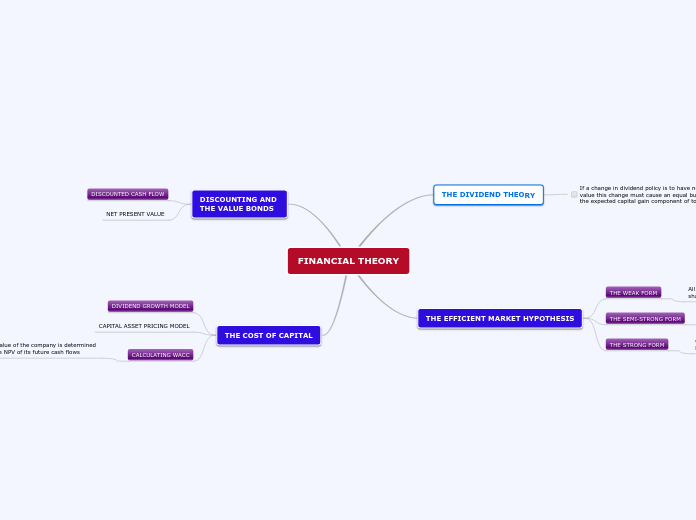

FINANCIAL THEORY

Determining the value of a company involves understanding various financial theories and models. One critical aspect is calculating the cost of capital, which includes the weighted average cost of capital (