af Fabiana Paz 4 år siden

696

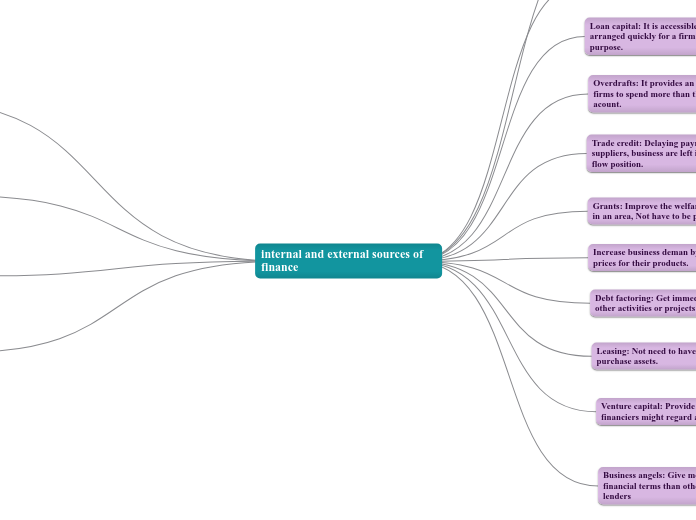

internal and external sources of finance

Businesses utilize various sources of finance to meet their operational and expansion needs. Internal finances include retained profits, personal funds, and the sale of assets, which offer control and cost benefits without incurring interest.