Microeconomics - Chapter 9 - The Basic Tools of Finance

TESTING POINTS

Questions for Review

Quick Quiz

Question 3

Fortune magazine regularly publishes a list sof the "most respected"companies. According to the efficient markets hypothesis, if you restrict yourstock portfolio to these companies, would you earn a better then average return?

explain

Question 2

Describe three ways that a risk-averse person might reduce the risk she faces

Question 1

The interst Rate is 7 percent.What is the present value of $150 to be recievedin 10 years?

MODELS

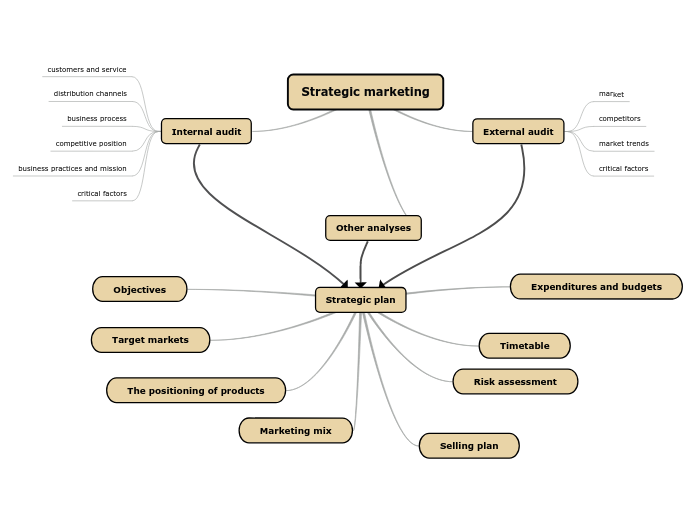

The Trade off Between Risk and Return - F9.3

Diversification Reduces Risk - F9.2

Subtopic

The Utility Function - F9.1

LEARNING OBJECTIVES

Examine what determines the value of an asset

Learn how to manage risk

Measure the value of money at different points in time

EXTRA READING

In the News

Some Lessons From Enron

Investors Behaviour Clouds the Wisdom of Offering Wider Choice in 401(k)'s

CASE STUDY

RANDOM WALKS AND INDEX FUNDS

FYI

The Magic of Compoundingand the Rule of 70

FORUMALS

rule of 70

Where:r = interest raten= yearsP = starting

( 1 + r )^n x P

SUMMARY

The value of an asset, such as a share of stock, equals the presentvalue of the cash flows the owner of the share will recieve, includingthe stream of dividends, and the final sale price. According to the efficientmarkets hypothesis, financial markets process available information rationally,so a stock price always equals the best estimate of the value of the underlyingbusiness. Some economists equestion the efficient markets hypothesis, however,and beleive that irrational psychologyical factors also influence asset prices.

Because of diminishing marginal utility, most people are riskaverse. Risk-averse people can reduce using insurance, throughdiversification, and by choosing a portfolio with lower risk andlower return.

Because savings can earn interst, a sum of moneytoday is more valuable than the same sum of moneyin the future. A person can compare sums from differenttimes using the concept of present value. The present value of an future sum is the amount it would be needed today,given prevailing interest rates, to produce that future sum.

ASSET VALUATION

Market Irrationality

The Efficient Marktes Hypothesis

Fundamental Analysis

dividends

fairly valued

overvalued

undervalued

MANAGING RISK

The Tradeoff between Risk and Return

Diversification of Idiosyncratic Risk

standard deviation

The Markets for Insurance

moral hazard

adverse selection

annuity

Risk Aversion

PRESENT VALUE: MEASING THE TIME VALUE OF MONEY

If r is the interst rate, then an amount X to be recieved in N years has present value of X / ( 1 + r )^N

Questions

Second Example

First Example

A: Assume 10 years at 5%

( 1.05 )^10 x 100

$163

Q: What is the Future value of $100in N years

KEY TERMS

random walk

the path of a variable whose changes are impossibleto predict

informationally efficient

reflecting all available information in a rational way

efficent markets hypothesis

the theory that asset prices reflect all publicly availableinformation about the value of an asset

fundamental analysis

the study of a company's accounting statementsand future prospects to determine its value

aggregate risk

risk that affects all economic actors at once

idiosyncratic risk

risk that affects only a single economic actor

diversification

the reduction of risk achieved by replacing a single riskwith a large number of smaller unrelated risks

risk averse

exhibiting a dislike of uncertainty

compounding

the accumulation of a sume of money in, say, a bankaccount, where the interest earned remains in the accountto earn additional interest in the future

future value

the amount of money in the future that anamount of money today will yield, given prevailing interest rates

present value

the amount of money today that would be needed to produce, using prevailing interest rates, a given future amount of money

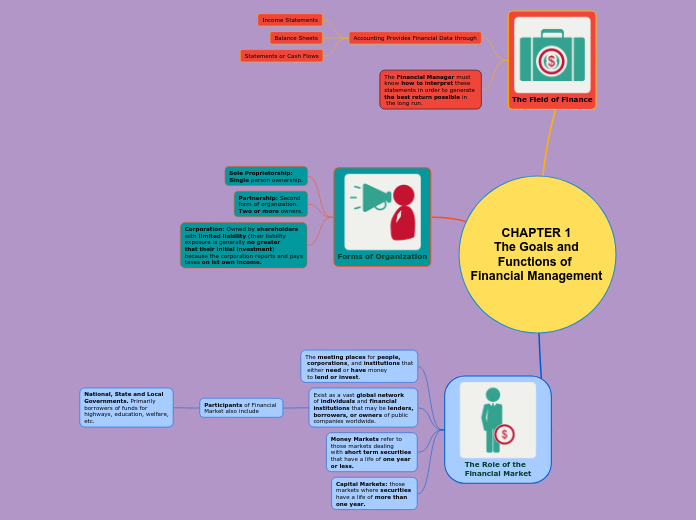

finance

the field that studies how people make decisions regarding the allocation of resources over time and the handling of risk

Introduction