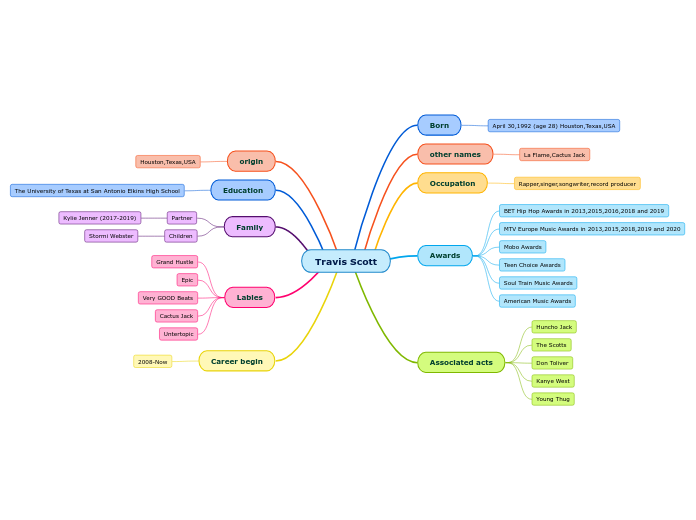

requirements:

completing the required coursework and passing an exam

requirements:

- graduation from college or university

- four-part examination

- 2 years experience as an internal auditor

management accountant

internal auditor

public accountant

facts and figures

How fast?

promotion to more

responsible positions in 1

or 2 years

promotion to senior positions within another few years

When?

In public accounting

or business firms

internship

How to get

experience?

on part-time

in summer time

Acounting and

auditing

Professional

organizations of

accountants and

auditors in the

USA

State Board

of

Accountancy

Certified Public Accountants (CPA)

- Uniform CPA Examination

Four-part Uniform CPA Examination. The 2-day CPA examination is rigorous, and only about one-quarter of those who take it each year passes every part they attempt. Candidates are not required to pass all four parts at once, but most States require candidates to pass at least two parts for partial credit and to complete all four sections within a certain period. In May 2004, the CPA exam became computerized and offered quarterly at various testing centers throughout the United States.

- completing 150 semester hours of college coursework – an additional 30 hours beyond the usual 4-year bachelor’s degree.

requirements:

- graduation from college or several years of experience as a public accountant

Requirements for the positions of accountant and auditor

additional

experience

preferable

bachelor’s degree

minimum

master’s degree

obligatory

continuing professional education

group study programs

seminars

courses

Advance to career

having inadequate academic preparation

rapidly

capable accountants and auditors

difficult

Necessary abilities for building an accounting career

to have high standards of integrity

be familiar with basic accounting software packages

be able to

working with people, as well as with business systems and computers

clearly communicate the results of their work

interpret

compare

analyze

aptitude for mathematics

Occupational mobility