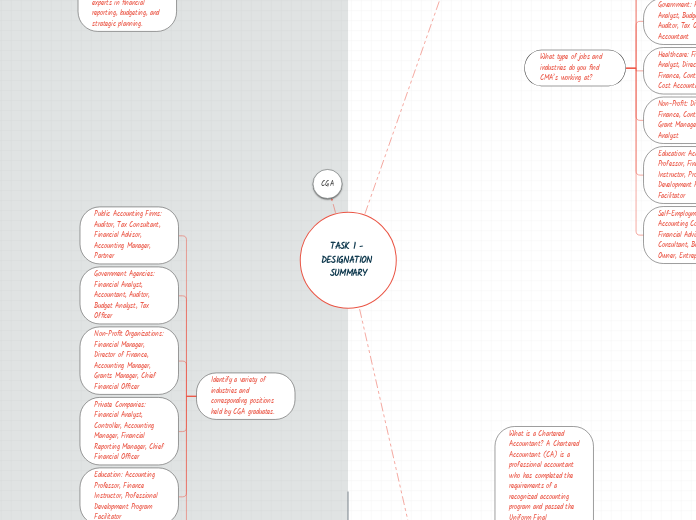

TASK 1 - DESIGNATION SUMMARY

title here

CGA

Identify a variety of industries and corresponding positions held by CGA graduates.

Private Companies: Financial Analyst, Controller, Accounting Manager, Financial Reporting Manager, Chief Financial Officer

Non-Profit Organizations: Financial Manager, Director of Finance, Accounting Manager, Grants Manager, Chief Financial Officer

Government Agencies: Financial Analyst, Accountant, Auditor, Budget Analyst, Tax Officer

Public Accounting Firms: Auditor, Tax Consultant, Financial Advisor, Accounting Manager, Partner

What is a certified general accountant?

A CGA is a professional accounting designation given to accountants that met industry standards by the former Certified General Accountants Association of Canada. CGAs are experts in financial reporting, budgeting, and strategic planning.

The Requirements to becoming a CGA:

Ethics and Professionalism: Candidates needed to demonstrate a commitment to ethics and professionalism by signing and adhering to CGA-Canada's Code of Ethical Principles and Rules of Conduct.

Exam Completion: Candidates needed to successfully complete the CGA program's six academic modules and pass a series of rigorous examinations.

Professional Experience: Candidates needed to complete a minimum of two years of relevant work experience under the supervision of a CGA or other recognized accounting professional.

Program Enrollment: Candidates needed to enroll in the CGA program offered by CGA-Canada or one of the regional CGA associations.

Education: CGA candidates needed to have a post-secondary degree from an accredited institution or equivalent education and training.

CA

Identify the industries and types of positions held by CA’s.

Not-for-profit: CAs worked for not-for-profit organizations, such as charities and non-governmental organizations, in roles such as treasurer, financial analyst, and auditor.

Education: CAs also worked in education, often as professors or instructors in accounting and finance programs at colleges and universities.

Government: CAs worked for various levels of government, including federal, provincial, and municipal, in roles such as auditor, financial analyst, and budget officer.

Corporate accounting: CAs were employed by corporations of all sizes and industries, where they held job titles such as controller, CFO, and financial analyst, and were responsible for financial reporting, budgeting, and strategic financial management.

Public accounting: CAs often worked in public accounting firms, providing services such as auditing, taxation, and consulting to clients in various industries, including manufacturing, financial services, healthcare, and not-for-profit.

What is a Chartered Accountant? A Chartered Accountant (CA) is a professional accountant who has completed the requirements of a recognized accounting program and passed the Uniform Final Examination. They are trained in a wide range of accounting, finance, and business topics, and are equipped to provide financial advice, perform audits, and prepare financial statements for businesses, organizations, and individuals.

Requirements to become a Chartered Accountant

Membership: Application and acceptance as a member of the provincial or territorial institute of Chartered Accountants.

Professional Ethics: Completion of a professional ethics course and agreement to abide by the professional standards and ethical principles set by the profession.

Uniform Final Exam: Successful completion of the Uniform Final Examination (UFE), which is a comprehensive exam that tests knowledge and skills in accounting, finance, and business.

Practical experience: Completion of a prescribed period of practical experience in accounting, finance, and business, typically under the supervision of a practicing CA.

Education: Completion of a university degree in accounting, business, or a related field, or equivalent education.

CMA

What type of jobs and industries do you find CMA’s working at?

Self-Employment: Accounting Consultant, Financial Advisor, Tax Consultant, Business Owner, Entrepreneur

Education: Accounting Professor, Finance Instructor, Professional Development Program Facilitator

Non-Profit: Director of Finance, Controller, CFO, Grant Manager, Financial Analyst

Healthcare: Financial Analyst, Director of Finance, Controller, CFO, Cost Accountant

Government: Financial Analyst, Budget Analyst, Auditor, Tax Officer, Accountant

Manufacturing: Cost Accountant, Operations Manager, Financial Analyst, Budget Analyst, Controller

Financial Services: Financial Analyst, Investment Manager, Risk Manager, Asset Manager, Portfolio Manager

What is a Certified Management Accountant? A CMA is a professional accounting designation that focuses on management accounting and strategic financial management. CMAs are trained to help organizations make informed business decisions by analyzing financial data, identifying trends, and creating forecasts.

What are the requirements in order to become a CMA?

Ethics and Professionalism: Candidates needed to demonstrate a commitment to ethics and professionalism by signing and adhering to the CMA Code of Ethics.

Exam Completion: Candidates needed to successfully complete the CMA program's strategic leadership program and pass a series of rigorous examinations.

Professional Experience: Candidates needed to complete a minimum of two years of relevant work experience under the supervision of a CMA or other recognized accounting professional.

CMA Program: Candidates needed to enroll in the CMA program offered by the Society of Management Accountants of Canada (now known as CPA Canada).

Education: CMA candidates needed to have a university degree or equivalent education and training from an accredited institution.