von Alicia Grebner Vor 12 Jahren

259

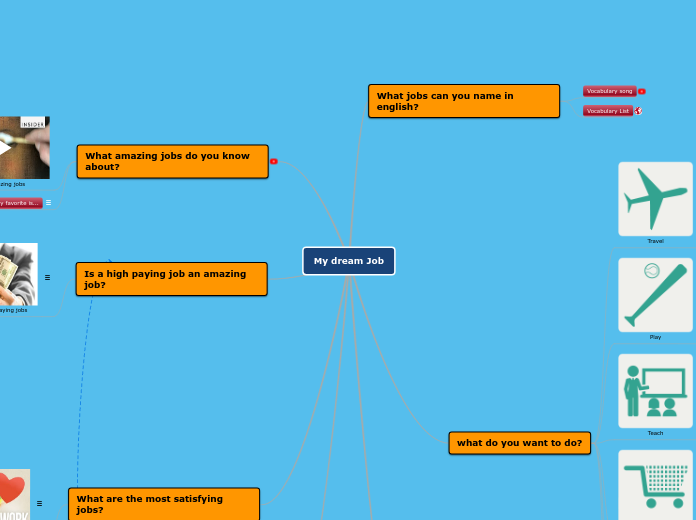

Professor R

A distinguished professor and national expert in financial planning and fiduciary law aspires to make all financial planners adhere to fiduciary standards. He is currently focused on transitioning his business shares to partners and is contemplating retirement, aiming to continue his contributions to academia and research as long as health permits.