Members of group 1:

* Laura Catalina García Toca - 68892

* Mariana Ruiz Hernández - 55594

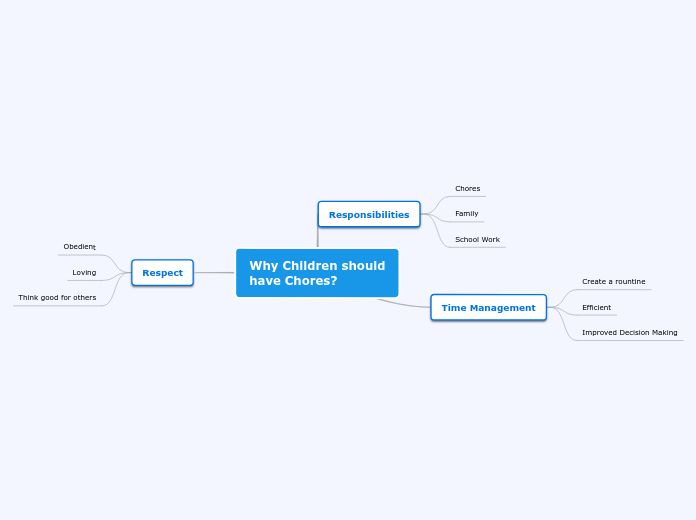

Parts of interest whose value may be unequal

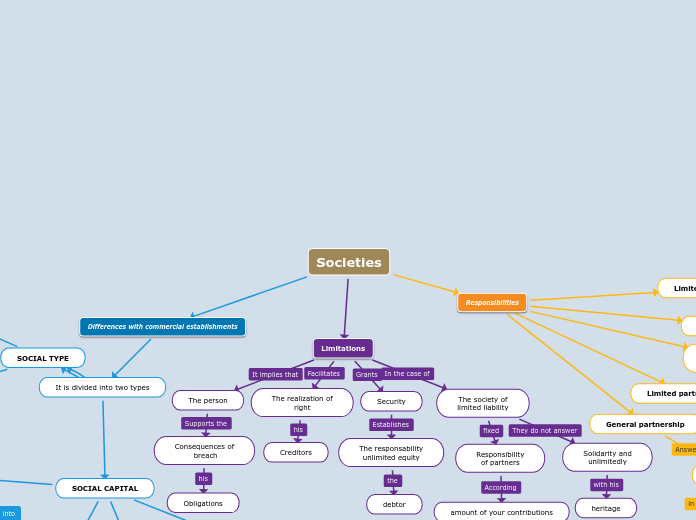

Societies

Limitations

The society of

limited liability

Solidarity and

unlimitedly

heritage

Responsibility

of partners

amount of your contributions

Security

The responsability

unlimited equity

debtor

The realization of

right

Creditors

The person

Consequences of

breach

Obligations

Responsibilities

General partnership

Solidarity

Taxes, updates

and interests

Input

taxable period

Laboral obligations

the limit of

responsibility

each partner

Limited partnership

The partners

managers

Make contributions

Solidarity and

unlimited

Take responsibility

Social operations

Simplified stock

companies

Defrauding the

the law

Participants in the

fraudulent acts

Joint stock companies

The shareholders

Social

obligations

Limited liability company

the partners

amount of their

contributions

Differences with commercial establishments

It is divided into two types

SOCIAL TYPE

Limited Liability Company

Anonymous Society

Shareholders

Simple limited partnership and by shares

Limited partners

Groups or Managers

Partners

SOCIAL CAPITAL

Anonymous society

Preferred shares

Shares of enjoyment or industries

Dividend Stocks

Bonds converted into shares

Outstanding shares correspond to capital

Limited Company by Shares

Requires statutory reform

Shares of equal value

Simple Limited Company

Partner contributions

Quotas of equal value

Collective Society

Requires tax reform

Each partner has one vote