por Victoria Kuhn hace 5 años

251

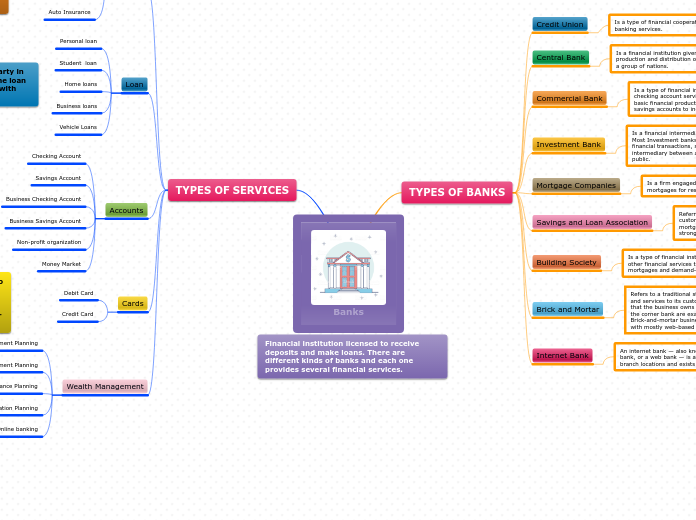

Banks2

Financial services encompass a wide range of offerings designed to address various needs, from protection against losses to the management of wealth. Insurance policies provide a safety net by offering financial reimbursement for specified losses.