por Ronald Ng hace 4 años

803

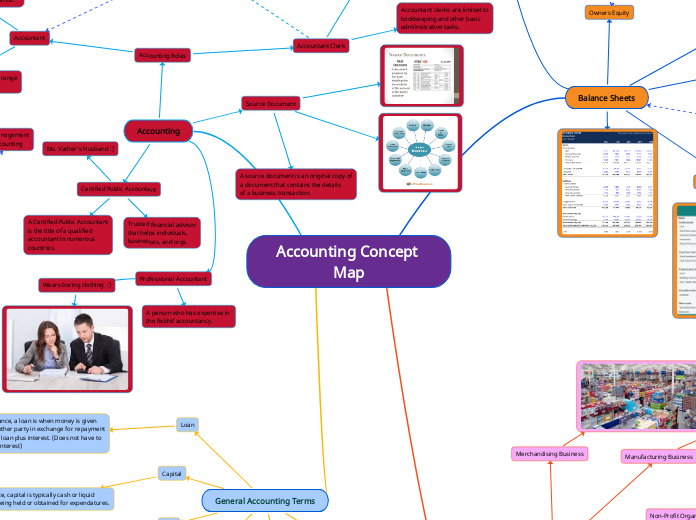

Concept Map

The account balance represents the current amount of money in an account, usually showing debit for assets and credit for liabilities and owner's equity, with exceptional balances indicating negative amounts.