por conor kingsley hace 2 años

173

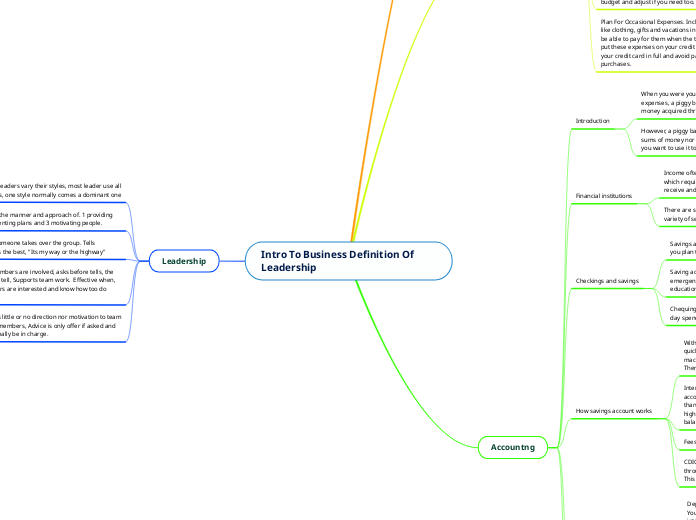

Intro To Business Definition Of Leadership

A piggy bank may work for young children with minimal income and expenses, but it is not ideal for managing larger sums of money or regular payments. Savings accounts offer a better solution by providing interest, easy withdrawals through ATMs or bank tellers, and protection through the Canada Deposit Insurance Corporation (