Macroeconomics 1BB3 - Chapter 12 - Money Growth and Inflation

TESTING QUESTIONS

QUESTIONS FOR REVIEW

Question 7

If the inflation is less than expected, who benefits - debtors or creditors? Explain.

Question 6

Which of these costs do you think are most important forthe Canadian economy?

What are the costs of inflation?

Question 5

According to the Fisher effect, how does an increasein the inflation rate affect the real interest rate andthe nominal interest rate?

Question 4

How does thinking about inflation help explainhyperinflation?

In what sense is inflation like a tax?

Question 3

According to the principles of monetery neutrality,which variables are affected by the changes in thequantity of money?

Explain the difference between nominal and realvariables, and give two examples of each

According to the quantity theory of money,what is the effect of an increase in the quantityof money?

Explain how an increase in the price level affectsthe real value of money

QUICK QUIZ

Question 2

List and describe six costs of inflation

Question 1

The government of a country increases the growth rate of the moneysupply from 5% per year to 50% per year.

Why might the government be doing this?

What happens to nominal interest rates?

What happens to prices?

EXTRA READING

IN THE NEWS

How to Protect Your Savings From Inflation

Inflation Fighters for the Long Term

The Hyperinflation in Serbia

Special, Today Only: 6 Million Dinarsfor a Snickers Bar

Russia Turns to the Inflation Tax

Russia's New Leaders Plan to Pay Debtsby Printing Money

CASE STUDY

Money Growth, Inflation, and the Bank of Canada

Money and Prices During Four Hyperinflations

FORMULAS

Interst Rates

Nominal interest rate = Real interest rate + Inflation rate

Real Interest rate = Nominal interest rate - Inflation rate

Quantity equation

Velocity of money equation

SUMMARY

Point 6

Many of these costs are large during hyperinflation,but the size of these costs for modeterate inflationis less clear.

Economists have indentified six costs of inflation:

and arbitrary redistributions of wealth betwen debtros and creditors

confusion and inconvenience resulting from a changing unit of account

unintended changes in tax liabilities due to nonindexation of the tax code

increased variability of relative prices

menu costs associated with more frequent adjustment of prices

shoeleather costs associated with reduced money holdings

Point 5

This view is a fallacy, however, because inflation also raises nominal incomes.

Many people think that inflation makes them poorer because it raises the cost of what they buy.

Point 4

According to the Fisher effect, when inflation rises, the nominal interest raterises by teh same amount, so that the real interest rate remains the same.

One application of the principle of monetary neutrality is the Fishereffect.

Point 3

When countries rely heavily on this "inflation tax," the result is hyperinflation

The government can pay for some it its spending by printing money.

Point 2

Most economists beleive that monetary neutrality approximatelydescribes the behaviour of the economy in the long run.

The principle of monetary neutrality asserts that changes in thequantity of money influence nominal variables but not real variables

Point 1

Persistant growth in the quantity of money supplied leadsto continuing inflation.

When the central bank increases teh supply of money, it caussthe price level to rise.

The overall level of prices in an economy adjusts to bringmoney supply and money demand into balance.

THE COSTS OF INFLATION

A SPECIAL COST OF UNEXPTECTED INFLATION:ARBITRARY REDISTRIBUTIONS OF WEALTH

CONFUSION AND INCONVENIENCE

INFLATION-INDUCED TAX DISTORTIONS

capital gains

RELATIVE-PRICE VARIABILITY AND THE MISALLOCATIONOF RESOURCES

MENU COSTS

SHOELEATHER COSTS

A FALL IN PURCHASING POWER? THE INFLATION FALLACY

inflation does not itself reduce people's realpurchasing power

MODELS

TABLE 12.1

How Inflation Raises the Tax Burdenon Savings

FIGURE 12.5

The Nominal Interest Rate and theInflation Rate

FIGURE 12.4

Money and Prices during FourHyperinflations

FIGURE 12.3

Nominal GDP, the Quantity of Money,and the Velocity of Money

FIGURE 12.2

An increase in the Money Supply

FIGURE 12.1

How the Supply and Demand for Money Determinethe Equilibrium Price Level

THE CLASSICAL THEORY OF INFLATION

THE FISHER EFFECT

when the Bank of Canada increases the rate of moneygrowth, the result is both a higher inflation rate and ahigher nominal interest rate

real interest rate

nominal interest rate

THE INFLATION TAX

the inflation tax is like a tax on everyone who holds money

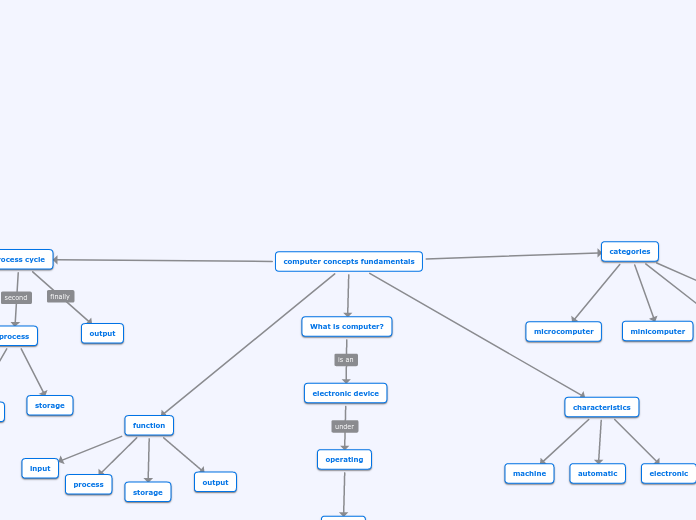

VELOCITY AND THE QUANITY EQUATION

Quantity theory of Money

5 Steps for the essense of the

5. Therefore, when the central bank increases the money supplyrapidly, the result is a high rate of inflation

4. With output ( Y ) determined by factor supplies and technology,when the central bank alters the money supply ( M ) and inducespropotional changes in the nominal value of output ( P x Y ), thesechanges are reflected in changes in the price level ( P ).

3. The economy's output of goods and services ( Y ) isprimarily determined by factor supplies (labour, phyisicalcapital, human capital, and natural resources) and theavailable production technology. In particular becausemoney is neutral, money does not affect output.

2. Because velocity is stable, when the central bank changesthe quantity of money ( M ), it causes proportionate changesin the nominal value of output ( P x Y )

1. The velocity of money is relatively stable over time.

Quantity Equation

Where:M - quantity of moneyV - velocity of money( P x Y ) - nominal value of output)if:P - priceY - quantity of output

M x V = P x Y

relates the quantity of money to thenominal value of output

Velocity of Money Equation

V = ( P x Y ) / M

Where:V - velocity of moneyP - price level ( GDP deflator )Y - the quanitity of output ( real GDP )M - the quantity of money

nominal value of output ( nominal GDP)divided by the quantity of money

THE CLASSICAL DICHOTOMY AND MONETARY NETRALITY

actual

measured

relative

classical

dichotomy

A BRIEF LOOK AT THE ADJUSTMENT PROCESS

THE EFFECTS OF MONETARY INJECTION

MONEY SUPPLY, MONEY DEMAND, AND MONETARY EQUILIBRIUM

In the long run, the overall level of prices adjusts to the levelat which the demand for money equals the supply.

THE LEVEL OF PRICES AND THE VALUE OF MONEY

INTRODUCTION

hyperinflation

deflation

inflation

LEARNING OBJECTIVES

Consider the various costs that inflation imposeson society

Examine how the nominal interest rate respondsto the inflation rate

See why some countries print so much moneythat they experience hyperinflation

Learn the meaning of the classical dichotomyand monetary neutrality

See why inflation results from rapid growth inthe money supply

KEY TERMS

menu costs

the costs of changing prices

shoeleather costs

the resources wasted when inflation encouragespeople to reduce their money holdings

Fisher effect

the one-for-one adjustment of the nominal interestrate to the inflation rate

inflation tax

the revenue the government raises by creating money

quantity equation

the equation M x V = P x Y which relates the quantityof money, the velocity of money, and the dollar valueof the economy's output of goods and services

monetary neutrality

the proposition that changes in the money supplydo not affect real variables

classical dichotomy

the theoretical seperation of nominal and real variables

real variables

variables measured in physical units

nominal variables

variables measured in monetary units

quantity theory of money

a theory asserting that the quantity of money available determinesthe price level and that the growth rate in the quantity of money available determines the inflation rate