por charlotte deegan hace 5 años

3721

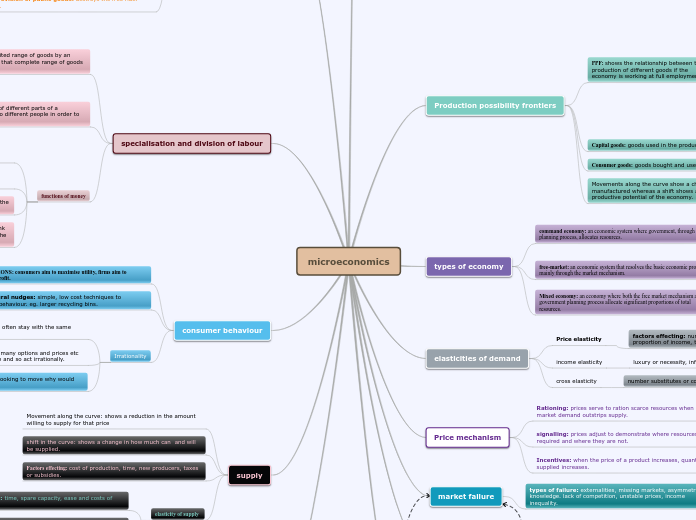

microeconomics

Microeconomics delves into the mechanisms that govern the allocation of resources and the functioning of markets. One key aspect is the price mechanism, which adjusts prices to signal where resources are needed and to ration scarce resources when demand exceeds supply.