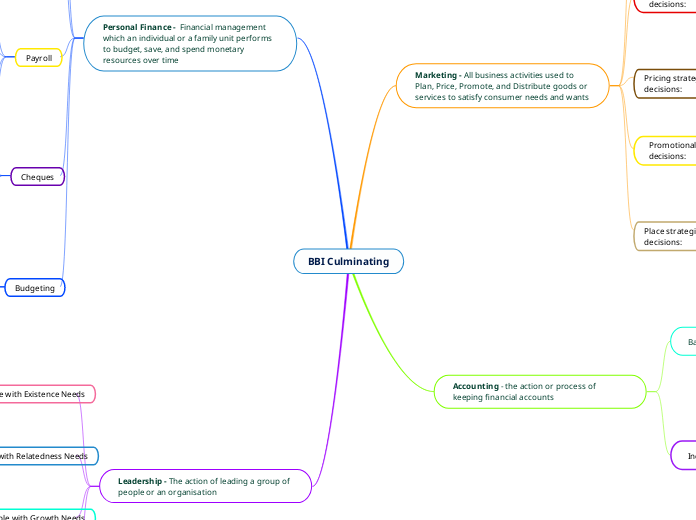

BBI Culminating

Marketing - All business activities used to

Plan, Price, Promote, and Distribute goods or services to satisfy consumer needs and wants

Product strategies may involve the following decisions:

What product to make.

How to package it (size, colour, shape).

What brand name to use.

What image to project.

What makes it different from it's competitors.

Pricing strategies involve the following decisions:

Reflect what a customer is willing to pay.

What competitors are selling their products for.

What image to project.

Promotional strategies involve the following decisions:

How potential customers will find out about a new product.

What the message will be (form and content).

When and where it will be delivered.

What incentives to buy the new product.

Place strategies involve the following decisions:

Where a product is to be distributed.

Location for stores?

How a product is to be distributed.

Storefront? Online? Both?

Accounting - the action or process of keeping financial accounts

Assets: Anything owned with a dollar value.

Liabilities: Anything the company owes money towards.

Owner's Equity: "Left over money", Assets - Liabilities.

Revenue - Expenses = Net Income (Loss).

Revenue: Money a business brings in.

Expenses: Costs to do business.

Net Income: Sales - Costs.

Personal Finance - Financial management which an individual or a family unit performs to budget, save, and spend monetary resources over time

Taxes

1. Income Tax - Anyone who earns an income has to pay federal and provincial income tax. (Goes towards: Defence, Canadian Debt, and Education, etc.)

2. Property Tax - Tax raised through the municipal government to pay for roads, snow removal, garbage collection, etc.

3. Harmonised Sales Tax - GST / PST: Goods and Service Tax (5% tax added to both goods and services) Provincial Sales Tax (8% retail tax on goods only).

4. Licensing - Raise funds through driver's licence, plates, permits, hunting/fishing/boating licences, etc.

Saving and Banking

Saving accounts – allow you to set money aside

for emergencies, save for a large purchase or

build funds for your education – while keeping

your money readily accessible.

Chequing accounts – for money that you plan to use for day-to-day spending or to pay bills.

Banks and trust companies – make money for the people who own their shares.

Credit unions – owned and run by the members who bank there. They may charge a refundable membership fee to join.

Payroll

Gross Pay - Total pay BEFORE deductions.

Net Pay - “Take Home” pay. Actual amount on your paycheck after deductions.

Deductions - Mandatory gov’t & any voluntary amounts taken off of your gross pay - Mandatory gov’t & any voluntary amounts taken off of your gross pay.

Salary - Get paid the same amount every pay - not paid for any overtime.

Cheques

A cheque also is a piece of paper that you can give to someone in exchange for goods and services.

The amount you write on the cheque is the amount that the recipient is to receive when the cheque is cashed at a financial institution.

If you do write a cheque for an amount that exceeds your bank account balance, your cheque will be classified as being NSF (Nonsufficient Funds) for which you will be charged an NSF fee.

Cheques are usually valid for six (6) months, after that period of time they are not valid and are said to be stale dated.

Budgeting

Keep track of your income and expenses

Stay on top of your monthly bills

Be prepared for unexpected expenses

Avoid overspending

Figure out how much you need to save to meet your financial goals.

Leadership - The action of leading a group of people or an organisation

Motivating People with Existence Needs

Pay people enough.

Safe workplace and a good environment.

Incentives – employee of the month.

Motivating People with Relatedness Needs

Show respect.

Delegate – give responsibility.

Give recognition.

Motivating People with Growth Needs

Offer support to complete new tasks.

Give staff and employees a challenge.

Work should be made interesting.

Why Do People Become Demotivated?

Lack of recognition.

Boredom.

Lack of involvement.