Trade Barriers in IB

Tarrifs

DEFINITION: Tariffs are taxes or duties paid on certain types of imports.

EXAMPLE: President Donald Trump imposed a 25% tariff on steel and 10% tax on on aluminium. This tariff will raise the costs for the steel users such as automakers. This will then increase the price for consumers.

Subsidies

DEFINITION: subsidies is money loaned

from the government to certain industries

to help them with costs and as well to keep

prices for consumers lower.

EXAMPLE: The agricultural industry is helped

by the Canadian government or Canadian agricultural programs that specify in subsidies. This helps farmers with their business.

Embargoes

DEFINITION: A trading/commercial ban

with a certain country.

EXAMPLE: In 2017, Canada imposed a trading ban on Venezuela due to a human rights violation during a violent protest in Venezuela.

Currency fluctuations

DEFINITION: is a change in an exchange rate.

It is a natural outcome of the exchange rate

system.

EXAMPLE : For example, assume you are a U.S. exporter who sold a million widgets at $10 each to a buyer in Europe two years ago, when the exchange rate was €1=$1.25. The cost to your European buyer was therefore €8 per widget. Your buyer is now negotiating a better price for a large order, and because the dollar has declined to 1.35 per euro, you can afford to give the buyer a price break while still clearing at least $10 per widget.

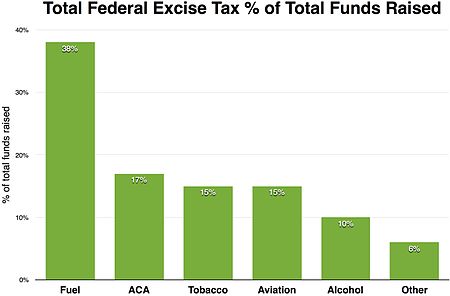

Excise Taxes

EXAMPLE: Alcohol and cigarettes are known

to harm a persons health, so excise taxes

are put on these products to reduce the

consumption of these goods.

DEFINITION: tax paid on the manufacture,sale

or consumption of a particular product

within a country.

Landed cost

EXAMPLE: To get specialty paper from

New Zealand, it costs 20.00 per 5000

sheets. These sheets will be exported

to Wales and the importation tariff is 5%.

All of these costs will give them the the

landed cost.

DEFINITION: Is the official cost for an

imported product. This determines whether a

foreign purchase is a better deal than a domestic

purchase. It is the purchase price + all shipping costs.

Standards

DEFINITION: An agreement between businesses with a set of rules for in doing something such as making a product, supplying the materials, managing the process,etc.

EXAMPLE: In a restaurant

business, the owner gives

the staff a set of rules/standards

they must meet. This could boost

their business.