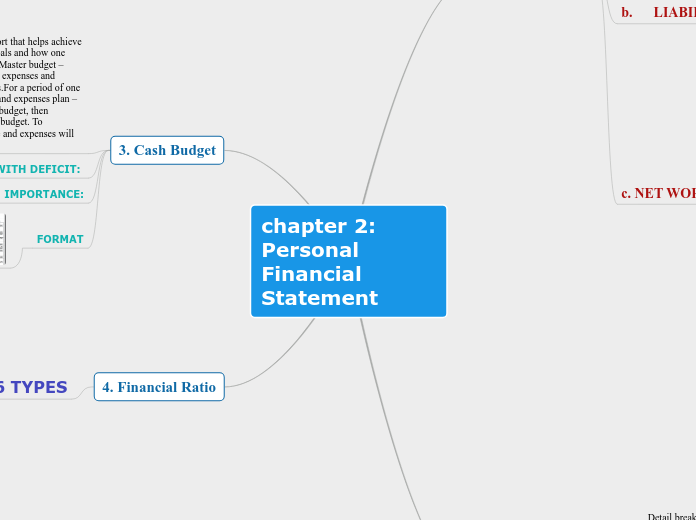

chapter 2: Personal Financial Statement

4. Financial Ratio

6 TYPES

6.DEBT RATIO

5.DEBT SERVICE COVERAGE RATIO

4.SAVINGS RATIO

3. LIQUID ASSET TO TAKE HOME PAY

2. CURRENT RATIO/LIQUIDITY RATIO

1.SOLVENCY RATIO

FORMULA

3. Cash Budget

IMPORTANCE:

DEALING WITH DEFICIT:

financial planning report that helps achieve short-term financial goals and how one uses his/her resources.Master budget – detail planned income, expenses and contribution of savings.For a period of one year.Monthly income and expenses plan – after doing the master budget, then preparing the monthly budget. To determine how income and expenses will take place.

EXPENSES

INCOME

2. Income Statement

Detail breakdown of cash income and expenses for a particular period of time.Importance. 1) it will indicate a person’s financial position. 2) It helps in doing the person’s budget

B. EXPENSES

importance:

VARIABLES

Expenses that can go up and down along with income. Ex increase in the traveling expenses as increase in traveling allowance (official duty).

Expenses that are paid and can be inflexible expenses. Ex: water bills, electricity bills.

Expenses that can be predicted. Buying foods, clothing

Can control especially in short run. Home maintenance, doctor’s bills, dentist's bills.

FIXED

Also known as sunk cost- cannot avoided.

Mortgage payments, car loan, insurance premium payments, rent.

Has little control in the short run

WHAT? Cash outflows.Needed to sustain a person’s life.

A. INCOME

EX: The major income source of income for an individual will be salary or wages.Bonuses, interest and dividends, proceeds from sale of assets, child support, tax refunds, gifts

Cash inflow or sources of income.

1. Balance Sheet

c. NET WORTH = (TA-TL)

Net Worth is a signal of one’s financial position. Alternative to increase net worth are: •To increase savings •To reduce spending •To increase the value of investment and other assets •To reduce liabilities

The Concept of Solvency

Insolvent net worth is negativeinsufficient assets to cover financial obligations

Solventnet worth is positivesufficient assets to cover financial obligations

Equity = actual ownership in an asset

b. LIABILITIES (OWE)

II. NON CURRENT LIABILITIES / LONG TERM DEBT debt due in 1 year or more. 1) non-current portion of loans with specific repayment schedules.

Ex: installment loans on cars (balance) , equipment, house or other property. 2) non-current portion of liabilities without specific repayment schedules. Ex: mortgage loans.

I. CURRENT LIABILITIES / SHORT TERM DEBT – debt due within 1 year.

Ex: utilities bills, payments for loans installments balance that are due within one year such as payments for personal loan or computer loan

a. ASSETS (OWN)

III. LIFESTYLE ASSETS are assets that help achieve desired quality of life.

Ex: residence, automobiles, jewelry, clothing, hand phone

iI. INVESTMENT ASSETS are assets being purchased for getting extra or side income.

Ex: preferred stocks, common stock, bonds, mutual funds and ASB

i. LIQUID ASSETS / CURRENT ASSETS cash or other assets that can be readily converted to cash with little or no loss in value.

Ex: cash on hand, current account, savings account and checking account

FORMAT