par Giovanni Quiroz Il y a 2 années

82

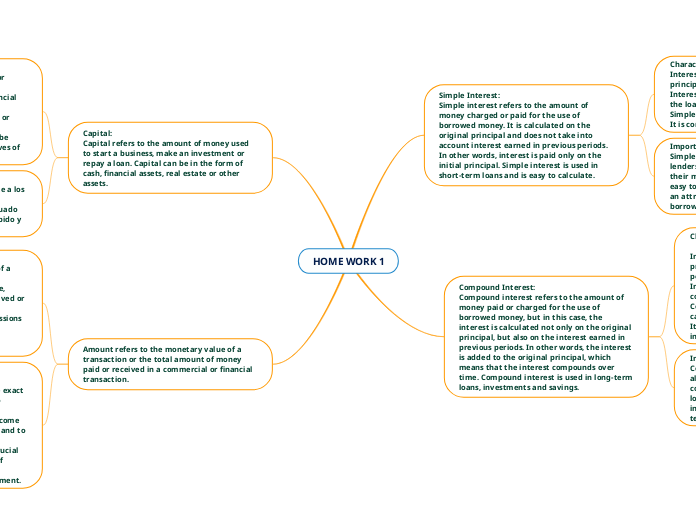

HOME WORK 1

The concept of "amount" is pivotal in financial transactions, representing the monetary value exchanged. This can encompass the total money paid or received, inclusive of taxes and additional charges, and is expressed in a specific currency.