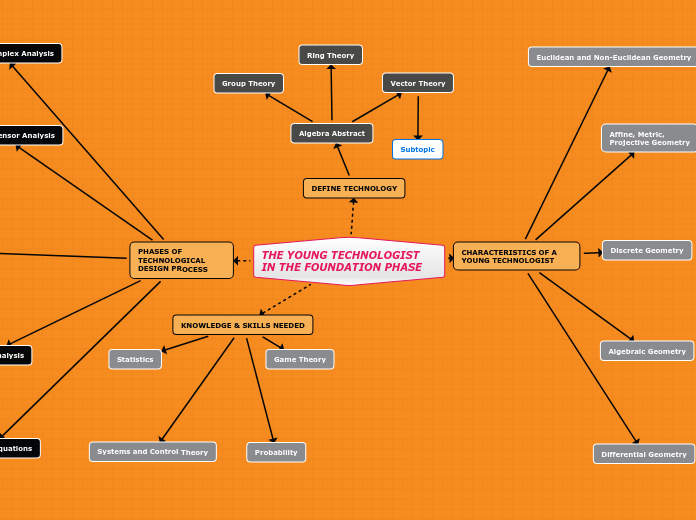

This concept map regards my career interest (Proprietary Trading), and attempts to show the process in which I ask necessary questions to find the answers I need.

Career advancement

What other opportunities would this career field offer me?

what would a promotion look like?

Management Position

Independent trader

Found their own Firm

Independent trader

Trading styles/methods

Considering that a firm could loss money from a bad trade.

What kind of constrictions would a Prop trader face, and how would that effect their trading style?

also, what returns does a firm expect from its traders?

Manual/Human trading

Automated trading

Automated trading and working as a programmer in a firm.

Algorithmic Trading

Black Box Trading

Risk Management

Quantitative Analysis

Event Based Trading

Other topics & Sources

These are topics that I may want to address and define, for my Week 7 assignment.

Sources:

http://www.wsj.com/

http://www.economist.com/

http://www.bloomberg.com/

http://www.investopedia.com/

Trading/Investment orginizations

Exchanges

What exchanges do firms trade through.

Investing

Cover the differences of trading and investing.

may need to explain things such as:

Hedge funds

Investment banks

Brokrage

Securities

What securities are often traded.

Derivatives

Currencies

Bonds

Equities

Market analysis

The three general forms of analyzing the market.

which form of analysis would a trading firm most likely use?

Quantitative Analysis

Technical

Sentimental

Fundamental

History of trading

The transition from trading on floors, to trading online.

Transition to Automated trading.

Fields in trading firms

Quantitative Analysis

Automated systems programmer

Risk management

Trading Firms

What firms are most commonly hiring

Prop traders?

Find Firms/Companies through job search engines:

http://www.indeed.com

https://www.monster.com

https://www.glassdoor.com

https://www.linkedin.com

Proprietary Trader

Explain what proprietary trading is.

Find details of: Trading firms, job requirements, salaries, fields in prop trading.

job search engines can help provide general details:

https://www.linkedin.com

https://www.monster.com

https://www.glassdoor.com

https://www.linkedin.com

Hiring proccess

Training

Required Education

Salary/Income

Can you expect to become wealthy from this line of work?

what is the average salary?

are there commissions?