a just vadim 3 éve

303

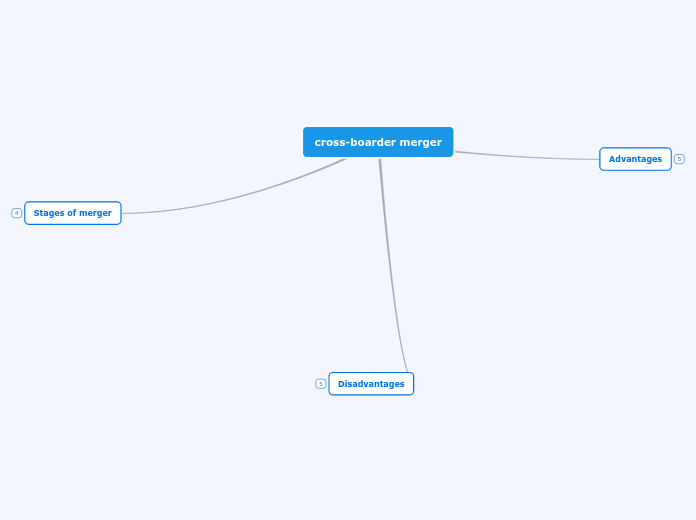

cross-boarder merger

When companies from different countries merge, the process involves several stages and carries both advantages and disadvantages. The initial phase involves screening potential partners based on their strengths and weaknesses.