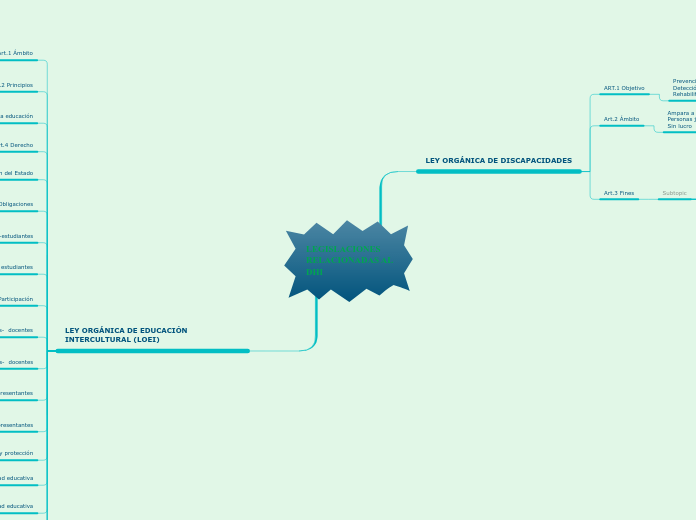

LEGISLACIONES RELACIONADAS AL DHI

Find out how much money you need to start a business with a break-even analysis.

It will help you determine when your business will become profitable.

LEY ORGÁNICA DE EDUCACIÓN INTERCULTURAL (LOEI)

Use this formula to find the break-even point.

Fixed Costs / (Average Price – Variable Costs) = Break-Even Point

Art.20 Asignación y distribución de recursos

Combina y artícula

Población

Territorio

Art.19 Objetivos

Diseñar y asegurar

Currículo nacional

Instituciones,niveles y modalidades

Art.18 Obligaciones

Convivencia armónica

Ambiente propicio

Art. 17 Derechos

Educación a lo largo de su vida

Participación

Fomentar

Art.16

Derechos y obligaciones- comunidad educativa

Actores individuales

Colectivos

Art. 15 Comunidad educativa

Conjunto de actores

Vinculados

Art.14 Exigibilidad , restitución y protección

Comunidad educativa

Instancia de protección

Art.13 Obligaciones- representantes

Cumplir la ley

Asistencia

Apoyar en actividades

Art 12 Derechos- representantes

Escoger la institución

Recibir informes

Directiva

Art.11 Obligaciones- docentes

Cumplir la Constitución

Laborar

Privacidad e íntimidad

Art 10 Derechos- docentes

Capacitación

Formación continua

Remuneración

Art. 9 Participación

Libertad

Organiza

Representa

Art.8 Obligaciones- estudiantes

Asistir

Tareas

Cuidar las instalaciones

Art.7 Derechos -estudiantes

Actores fundamentales

Formación integral

Becas y apoyo

Art.6 Obligaciones

Investiga

Erradica ( violencia , analfabetismo,)

Impulsa

Art.5 Obligación del Estado

Educación pública

Gratuita

Laica

Art.4 Derecho

The break-even point is the level of production at which the costs of production equal the revenues for a product.

Fixed Costs / (Average Price – Variable Costs) = Break-Even Point

Derecho humano

Garantizado en la Constitución

What is the break-even point?

Art.3 Fines de la educación

Variable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs over all units produced.

Personalidad

Capacidad de análisis

Autonomía y protección

What are the variable costs?

Art.2 Principios

To calculate the average purchase price of your shares you have to divide the total amount invested by the total number of shares bought.

Universalidades

Atención prioritaria

Flexibilidad

What is the average price?

Art.1 Ámbito

Fixed expenses or costs are those that do not fluctuate with changes in production level or sales volume.

They include such expenses as rent, insurance, dues and subscriptions, equipment leases, payments on loans, depreciation, management salaries, and advertising.

Derecho a la educación

Principios y fines

Interculturalidad y pluriculturalidad

What are the fixed costs?

LEY ORGÁNICA DE DISCAPACIDADES

Art.3 Fines

The Break-even analysis helps you analyze the data.

Subtopic

To improve the sales in your business, focus on the customers, and shift to increasing sales performance.

6. Inclusión plena

5.Corresponsabilidad y participación familiar

4.Eliminar formas de abandono

3. Cumplimiento de mecanismos

2.Promover e impulsar

1.Sistema nacional

Art.2 Ámbito

The Break-even analysis helps you price a product or service.

Ampara a extranjeros

Personas jurídicas , semipublicas

Sin lucro

Do some research and find competitor's prices.

Then try to establish your prices.

ART.1 Objetivo

The Break-even analysis helps you determine profitability.

Prevención

Detección oportuna

Rehabilitación

Revenue generation is one of the most important activities any business can engage in.

It is defined as a process by which a company plans how to market and sell its products or services, in order to generate income.