a Karyme Cardenas 2 éve

166

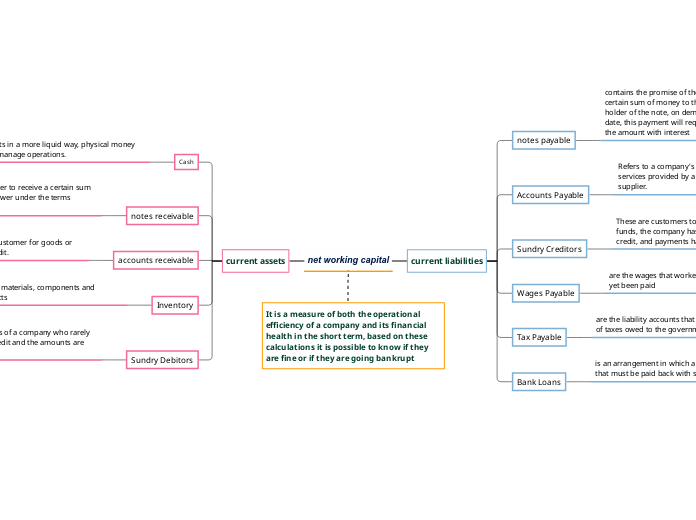

net working capital

Net working capital is a crucial metric for assessing the short-term financial health and operational efficiency of a company. It encompasses current assets like cash, inventory, and accounts receivable, which represent the funds and resources readily available for business operations.