PA2

ASPE TO IFRS

Things to consider

increased costs

increased reqporting and disclosures

complex

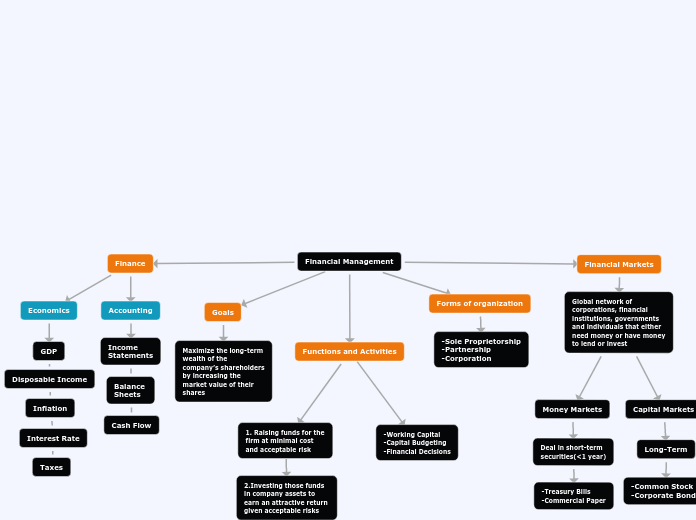

BUY or LEASE

Buy

how to finance

check CF

if CF is an issue

issue shares

financing thru banks

if there is bank covenant

covenant on ST debt

combo equity & LT debt

bonds

covenant on LT debt

consider equity financing

Lease

is there ownership or bargain purchase option

NO

Is lease term >= 75% of economic life

Is PV of pmts >=90% of FV

OPERATION LEASE

CAPITAL LEASE (IFRS) or FINANCE LEASE (ASPE)

ASPE

YES

CAPITAL LEASE

EXPANSION

TX: MPP deduction

NEED FOR CAPITAL BUDGET

RISKS

Operational risks

decrease in productivity

Equipment obsolence

Credit/Default risks

Stakeholders risks

key employees

CF risks

Business risks

Current financing options

Raising capital

Ways to raise capital

If public

Going IPO

Disadvantages

increase accountability,disclose compensation of executives and MD&A,interin financial statements,change in control,substantial costs for IPO i.e. legal,underwriter,securities registration,consulting,audit fees,loss of small business deduction, increase financial reporting and auditing requirements, must use IFRS.

Advantages

increase access to capital,improve ratios i.e.debt to equity,current ratio,financial leverage,increase cashfrom sale of shares,negociate better interest,increase consumers awareness.

Stock offering

Stock rights

will maintain current s/h ownership %

offer current s/h option to purchase additional shares

Preferred shares

Advantages & disadvantages

Disadvantages:cumulative feature may impose cash flow issues in a later year,not deductible for tax

Advantages:avoids dilution of ownership,can omit dividends in bad years,do not reduce reported income,improve debt to equity ratio if treated as equity.

features of the shares will determine if:

LIABILITY

redeption is at the s/h's discretion

cumulative at x%,callable,convertible

EQUITY

redemption is at company's discretion

paid before common shares

paid after bondholders are paid their guaranteed interest payment

paid when declared

Common shares

CON: will dilute ownership, change direction & focus of company,increase the probability of takeovers by a small margin, the new skares may depress stock price during and soon after issue of new shares.

PRO: attracts new s/h, no legal requirements to pay dividends,teherby reducing financial distress or insolvency,improve debt to equity covenants,dividends do not decrease reporting earnings.

TX: interest paid on bonds are tax deductible,thereby reducing after tax cist of capital

increase debt to equity covenants,potential loss of flexibility in future financing

If private

IPO

Issues with raising IPO

IT: must have financial system in place to produce timely, reliable, relevant F/S

FR: requires 2 years of financial records, must hire auditor

Complexities: increase reporting requirement, audited F/S, MD&A

Costs: prospectus prep, legal fees, registration, increase cost of assurance, implementation of more internal control

Borrowing

Restrictive covenants

cost of violating covenant: increase financing cost, loss of reputation, loss of sale, decrease in EPS

must comply with lending body (DO NOT VIOLATE)

Debt-to-equity ratio= total liab / shareholders equity

Working capital = current assets - current liabilities

Issue bonds

TX: interest paid on bonds are tax deductible

MUST PAY interest when not profitable

Using profits

CF if available

Main topic

MUDRA APPARELS LTD.

MEMO to CEO

risk management

Subtopic

MEDIUM

closing of plant

LT: employees may leave, expertise will be gone

ST: dec market share, loss of sales, dec EPS, dec SW

HIGH

acccounting issues

buy & lease

lease

good idea

cash management policy

cash budget

keep reserve

foregoing oppotunity cost

just bec there is excess cash, don't buy machines outright

QA

possible replacement

ongoing r&m

increased cost related to breakdown of equipment

link to I/S and GM

GM dec eventhough revenue increase

F/S presentation?

IFRS - absorption cost

inventory

production line is aligned to marketing and meeting sales projections (budget)

determine which section (clothing or accessories) is bringing in more sales (quality earnings)

bank requirements

LT: increase sales and deal with inventory issue

ST: infusion of cash from sale of the laser-cutting machine will improve current ratio

working capital

current ratio

acid test will indicate issues with inventory

MEMO to BD

market share

preliminary market research

increase market share by building the new facility

improve product quality

currently, not meeting targets (not meeting market needs)

not meeting targe

high inventory

expansion

negotiating point for bank if we lower covenant by selling laser-cutting machine

based on 20X5 R/E, retain R/E in pfd shares for expansion

disclosure of expansion in MD&A

gain bigger market share

will improve product quality

consider keeping the current facility open

keep skilled employees

recalculate NPV

qualitative factors

capital budget

scale down

financial results shows that we cannot carry more debt

strategic partners

common shares

dividend policy

preferred shares

features

accelerated rates

goes up - liability

redemption option

owner - liability

corporation to redeem - equity

dividends not tax deductible

stock rights

although, issuing bond is an option

INVENTORY VALUATION

net realizable value

BONUS PLAN

Ethics

manipulation of earnings

FR

timely, reliable, relevant information that captures data tied to the bonus plan

IT

link to financial system

a more robust IT is required to track the non-financial data

MA

better to use financial & non-financial data such as balanced scorecard

customers - market share, customer satisfaction measures, customer loyalty

leadership & training - morale, knowledge, turnover, use of best demonstrated practices

business processes - eliminatiion of bottlenecks, timeliness, productivity rates

financial - revenue, net income, return on capital, CF

using financial aspect only may lead to manager manipulating accounting policies

need for earnings management

(moral hazard) manager may shirk responsibilities

TAX

pay out within 180 days to be tax deductible