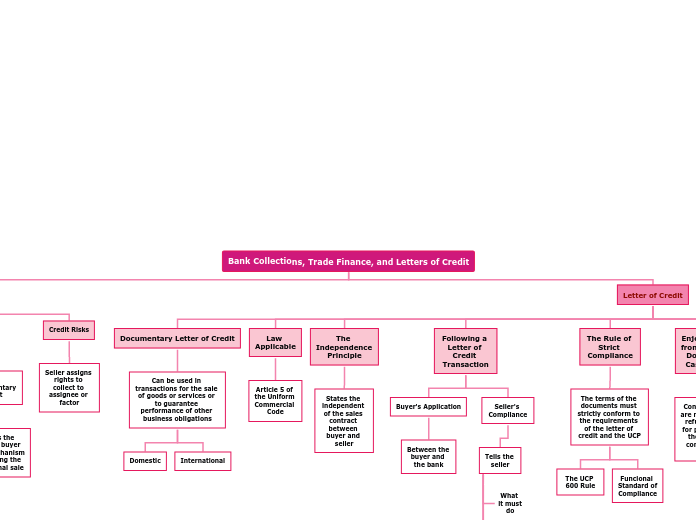

Bank Collections, Trade Finance, and Letters of Credit

Letter of Credit

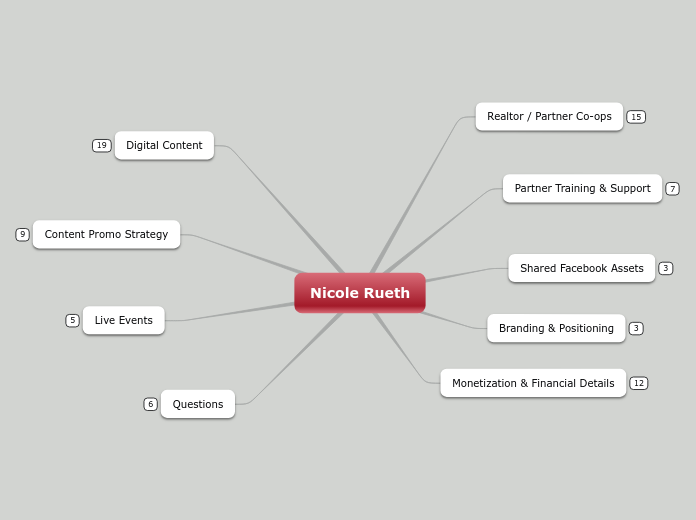

LOC in Trade Finance Programs

A partial loss to the insured’s cargo

Others Specialized Uses for LOC

Back-to-Back Letter of Credit Financing

Revolving and Evergreen Credits

Red Clauses in Credits

Transferable Credits

Standby Letters of Credit

One in which the issuer is obligated to pay a beneficiary upon the presentation of documents indicating a default by

The performance of an obligation

.

The account party in the payment of a debt

Confirmed Letters of Credit

One in which a second bank, has agreed to purchase documents and honor drafts onthe same terms as the original issuing bank

Enjoining Banks from Purchasing Documents in Cases of Fraud

Confirming banks are not permited to refuse a demand for payment when the documents comply with the LOC

The Rule of Strict Compliance

The terms of the documents must strictly conform to the requirements of the letter of credit and the UCP

Funcional Standard of Compliance

The UCP 600 Rule

Following a Letter of Credit Transaction

Seller's Compliance

Tells the seller

When to ship

How to ship

What to ship

What it must do

Buyer's Application

Between the buyer and the bank

The Independence Principle

States the independent of the sales contract between buyer and seller

Law Applicable

Article 5 of the Uniform Commercial Code

Documentary Letter of Credit

Can be used in transactions for the sale of goods or services or to guarantee performance of other business obligations

International

Domestic

The Bill of Exchange

Credit Risks

Seller assigns rights to collect to assignee or factor

Documentary Drafts Used in Trade Finance

The Documentary Draft

Provides the seller and buyer with a mechanism for financing the international sale

Trade finance

Provides immediate cash to the seller for the sale

Assists the buyer in financing its purchase

The Documentary Draft and the Bank Collection Process

Time Draft

Sent to the buyer for its acceptance

SightDraft

Payable on sight

Brief Requirements of a Bill of Exchange

The English Bills of Exchange Act requires

To: an specific person

A sum certain in money

Guarantee that it will be payed

Signed by the person giving it

Addressed by one person to another

An uncoditional order in writing

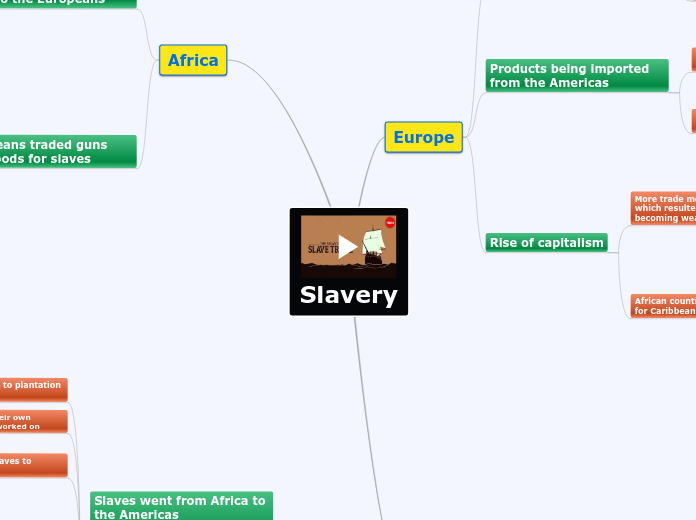

The Origin of the bill of exchange

Lies in the history of the merchants and traders of four teenth and fifteent century Europe