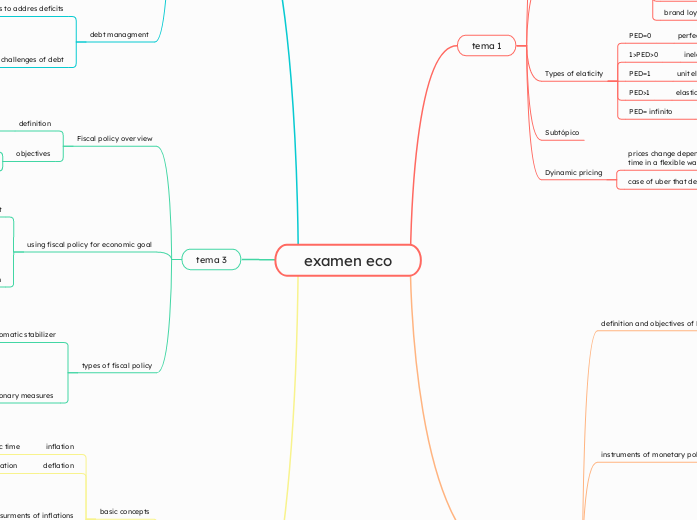

examen eco

tema 4

structural inflation

results from long-term structural bottle necks in the economy

q

inefective institutions

lack of infrastructure

insufficient competition

cost push inflarion

economics policy recommendation

reduce reliance in imports

encurage domestic production

supply policies

income policies

arises from

imported inflation

cost of foreign goods rises

profit push

businesses raising prices

wage push

increased labour cost

basic concepts

examples

deinflarion

smatphone prices are lowering

infaltion

annual price of a loaf of bread

Measurments of inflations

Core inflation

GDP deflatior

harmonixed indez of consumer prices (HICP)

consumer price index(CPI)

deflation

oposite of inflation

inflation

rate of increase in prices over a specific time

tema 3

types of fiscal policy

discretionary measures

deliberate actions by the goverment to adjust fiscal policy

managing budget deficit or surpluses

type and level of taxes

volume structure and composiotion of public expenditure

automatic stabilizer

operates counter-clyclical

contractionary periods

rise transfers to families

ex: tasa del paro

expansionary periods

rise of taxes

using fiscal policy for economic goal

to confront inflation

down goverment transfer payments

down public spenditures

rise taces for house holds and buisnesses to crub more explending

to foster employment

provide incentives to rise exports

Increase public spending

reduce corporate taxes to boost investment

Fiscal policy overview

objectives

redistribute income and wealth

increase or defrease agregate demand

governments budgetary decisions

tema 2

debt managment

challenges of debt

debt to GDP ratio

resource allocation

have to pay the interest of the debt in several years

primary methods to addres deficits

debt issue

limited monetisation

reasons for budget deficit

financial need of the state

increase in the agregate demand

budget

balanced budget

inflows=outflows

budget surplus

revenue> spendings

budget deficit

types

primary deficit

fiscal deficit- interest

fiscal deficit

total expenditures>total revenue - borrowing

revenue deficit

total expenditures> total revenue

spending> revenue

1 definition

budget spending

tipos

transfer payments

pensiones

current spending

funcionarios

capital spending

hospitales

lo que gasta un pais

budget revenue

total de ingresos de un pais

tema 5

impact of MP on economic variables

expectations about montetary variables

tools to affect expectations include

detailed economic and lysis provided by the CB study deparment

advertising

publicizing CB stratefues, goals and decisions

2

persuasion and comunication

instruments are used to shape economic agents' expectations regarding $ trends

amount of $ / interest rates

less

leads to low leadinf rates

expands funds for lending

more

leads to high leadinf rates

limits fund for lending

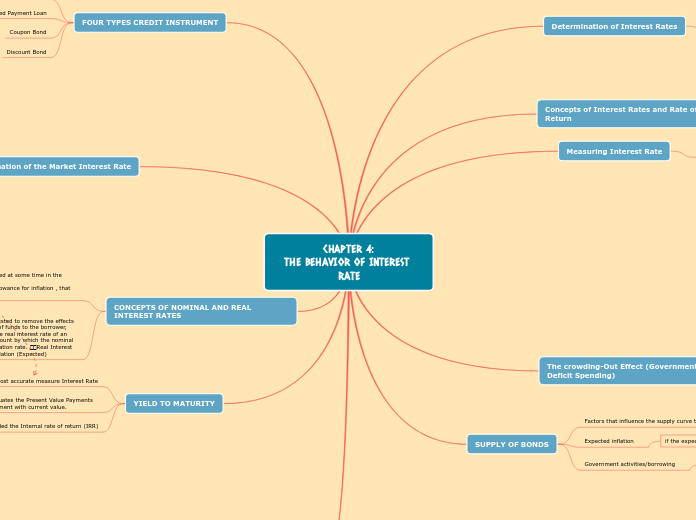

cash reserve ratio

increase

more credit costs

less credit availability

reductions

more credit availabilitity

open market operations

sale

more credit cost

contracts the MS

purachase

less credit cost

expand the Monetary supply

instruments of monetary policy

moral suasion

the CB uses to invluence financial institutions

advice

comunication

persuation

credit rationims

facilitating or limiting acced to credit by specific measurments

discount rate

low

borrowing is cheaper

mas money for leanding

high

borrowing becomes more expensive

menos money for lending

reserve requirements

increase inreserve ration

down liquidity available for credut

reduction inreserve ration

provide banks with more liquidity to extend credit

open marjet operations

purchase of securities

rise of money supply as funds move to comertial banks

definition and objectives of MP

historical context

monetarists

from the 1970s until 2008

main objective

inflation targeting: based on the quantity theory of money

(M x Vt = P x t)

definition

MP actions by the central bank to influenve

tema 1

Dyinamic pricing

case of uber that des this

prices change depending on what demand at the time in a flexible wat

Subtópico

Types of elaticity

PED= infinito

oerfectly elastic

productos iguales

PED>1

elastic

cocacola

PED=1

unit elastic

LV

1>PED>0

inelastic

gasolina

PED=0

perfectly inelastic

insulina

determining factors of PED

brand loyalty

price relative to income

cost of changes

availabblitly of close substitutes

luxury or not

1- Price elasticity demand

formula

%quantity changed/price change %

Definition

Is when th price of something changes and it variates the quantity of said good sold in the amrket