によって Kevin Hernandez 3年前.

534

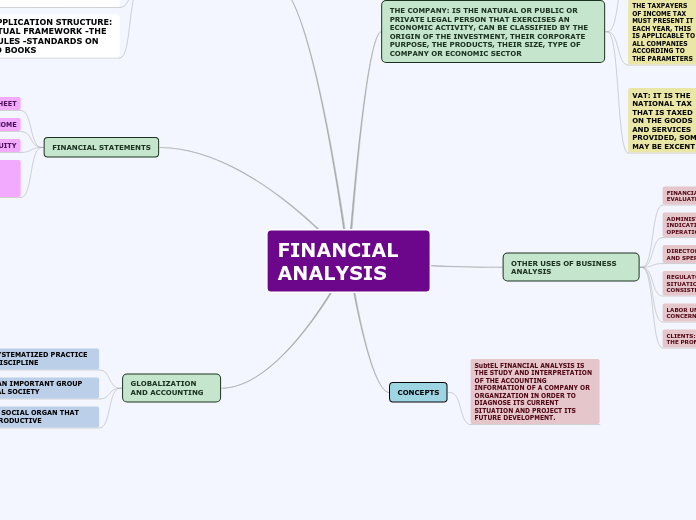

FINANCIAL ANALYSIS

Financial analysis involves the study and interpretation of accounting information to assess a company's current situation and predict future developments. Key elements include financial statements such as the statement of income and balance sheet, which provide quantitative data essential for decision-making.