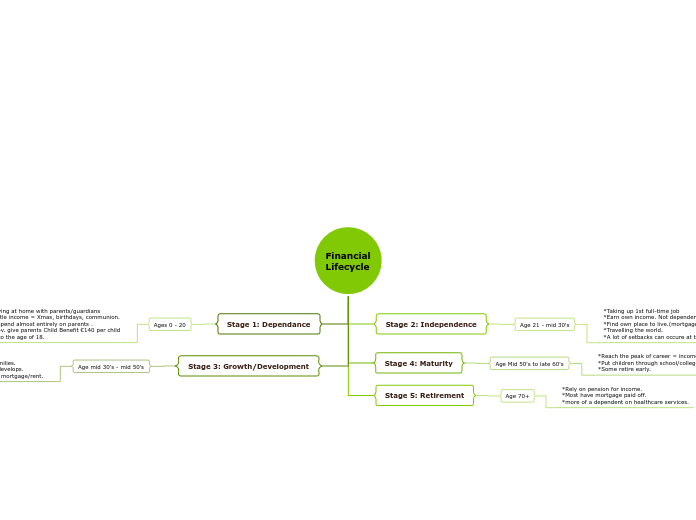

Financial

Lifecycle

The main purpose of timelines is to display a series of actions within a particular time interval. Timelines can cover a bigger time period, they should not be very detailed. Howbeit, it is possible to add images, data, or figures.

Stage 3: Growth/Development

Age mid 30's - mid 50's

*Wages can begin to rise.

*Most begin to settle and start families.

*A bigger sense of responsibility develops.

*Large mount of income spent on mortgage/rent.

Stage 5: Retirement

Age 70+

*Rely on pension for income.

*Most have mortgage paid off.

*more of a dependent on healthcare services.

Stage 1: Dependance

Ages 0 - 20

*Living at home with parents/guardians

*Little income = Xmas, birthdays, communion.

*Depend almost entirely on parents .

*Gov. give parents Child Benefit €140 per child

up to the age of 18.

Stage 4: Maturity

Age Mid 50's to late 60's

*Reach the peak of career = income reaches max.

*Put children through school/college.

*Some retire early.

Stage 2: Independence

Add date here.

Age 21 - mid 30's

Add the event here.

*Taking up 1st full-time job

*Earn own income. Not dependent on parents.

*Find own place to live.(mortgage)

*Travelling the world.

*A lot of setbacks can occure at this stage

You can add a few highlights here or if you want to add detailed description you can use the Notes feature.