によって FUT_Mara FUT_Mara 4年前.

215

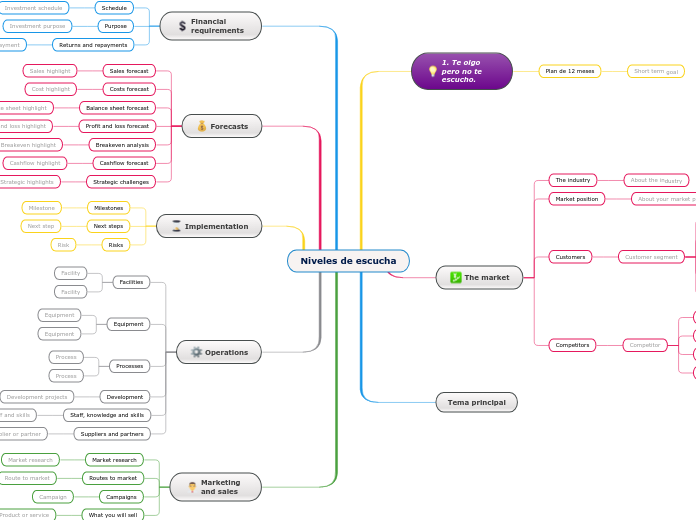

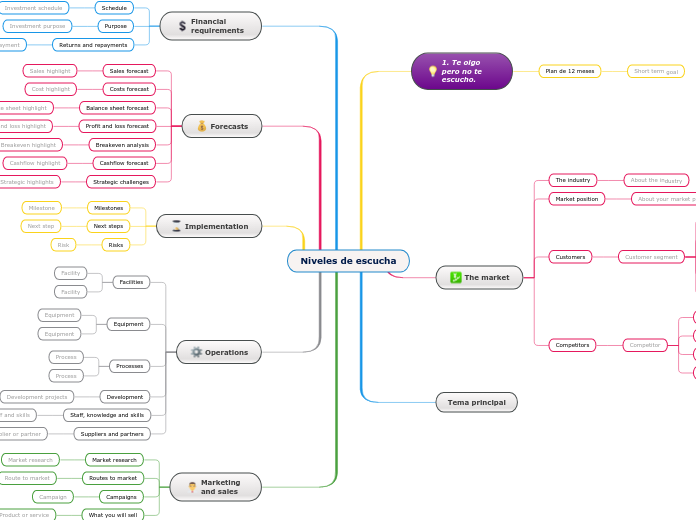

Niveles de escucha

Creating a comprehensive business plan involves a careful analysis of numerous facets. Financial aspects are crucial, requiring detailed forecasts for cash flow, profit and loss, and balance sheets.

によって FUT_Mara FUT_Mara 4年前.

215

もっと見る

Type in the name of your organization and press Enter.

The question that investors will ask is How will you turn your forecasts into reality?

Having identified your product or service, and the demand for it in the market, how will you reach that market?

Describe exactly what customers will buy, how they will buy it, how it will be provided or delivered, and how it will be supported after purchase.

Think about:

What campaigns are you planning to publicize your product or service? Examples include:

List the ways that you can reach your market segments. Examples include:

Add a description of your market research.

What market research have you done to identify the best routes to market for your particular segment?

How will the operations of your organization need to change, to support this plan?

Investors will need to know that you will also have the capabilities to deliver it, sustain it and scale it up.

Add a supplier or partner.

Add staff, knowledge or skills.

Add a development project.

What new processes will you need to establish? Do you need to change existing processes?

Processes include:

Add a process.

What new equipment and tools will you need? Will you replace old ones, or extend your capacity?

Add capital equipment.

How will your facilities need to change to implement your plan?

Will you need new premises or changes to existing premises?

Add a facility.

If you win the investment or support that you need, where will you start?

Add a risk.

Add the next step.

What are the key points in the implementation of your plan? How will you know that you are making real progress?

Think about:

Add a milestone.

You will need credible forecasts of profitability and strategic benefits if you are proposing investment in your business.

What is the impact on your strategy of this initiative? How will your strategy change to ensure that you can adapt to whatever this plan brings, whether it is good or not so good? Think about:

Add a strategic point.

Even if your plan will eventually be profitable, cashflow limitations could prevent you from getting there. Your cash flow forecast should show that you are in control of this.

Consider:

Add a key point from the cashflow forecast.

Your breakeven analysis should show the minimum level of achievement that is still survivable. If operations go below breakeven, then you will need to take evasive action. Make forecasts for:

Your profit and loss (or income) forecasts should detail where, when and how profitability will be achieved.

Add a highlight from your Profit and Loss forecast.

Consider making forecasts for year 1, year 2 and year 3 of your plan.

How will your balance sheet change as a result of this initiative?

Add a key point from the balance sheet forecast.

How will your costs base change as a result of your initiatives? Think about:

Add a key point from the costs forecast.

How will sales increase as a result of your initiatives? Think about:

Add a key point from the sales forecast.

It must be clear to investors what you are asking for, when you need it and when & how it will be repaid - in short, what value they will get for their investment.

Add highlights of the return or repayment plan for investors. Consider:

Add a sum-up of how this investment will be spent. Include:

Add a summary of how much is required and when.

Investors will ask: how well do you know your customers and your market? Your business plan should show that you are targeting your market by well-defined segments and are focused on creating value for customers.

Add an organization that can compete with you, either now or in the future. Think about all alternatives that the customer may have, including doing nothing or addressing their problem in a completely different way.

Strategies

Strategy

How will you compete effectively?

Add an element of your competitive strategy. Think about:

Weaknesses

Weakness

What do the competitors do that is less attractive than your product or service?

Do they have:

Strengths

Strength

What do the competitors do that is more attractive than your product or service?

Do they have:

Product or service

Describe the competing product or service

Who are your customers? Add a target customer segment. Groupings might include:

Solutions

What solutions are you offering for customers in this segment? What value do you create for them?

Add a solution.

Needs

What are the needs and interests of the customers in this segment? What do they value? How do they select their purchases?

Add a customer need.

Pain points

What problems and pain points do the customers in this segment face?

Add a pain point.

Profile

What is the characteristic of the customers in this segment?

How do you identify your potential customers?

Add a characteristic of the future customer.

Segment size

Size

What is the estimated size and value of this segment?

What proportion of the segment is potential customer for you, taking into account competitors, market maturity and demand?

What market position are you aiming at?

Think about:

Add some key points about the industry you are working in.

Describe the vision and the opportunity that the plan is based on.

The investor's question you answer here is Where are you headed, and why?

Where do you want to be in 12 months? Where would you like to be in terms of: