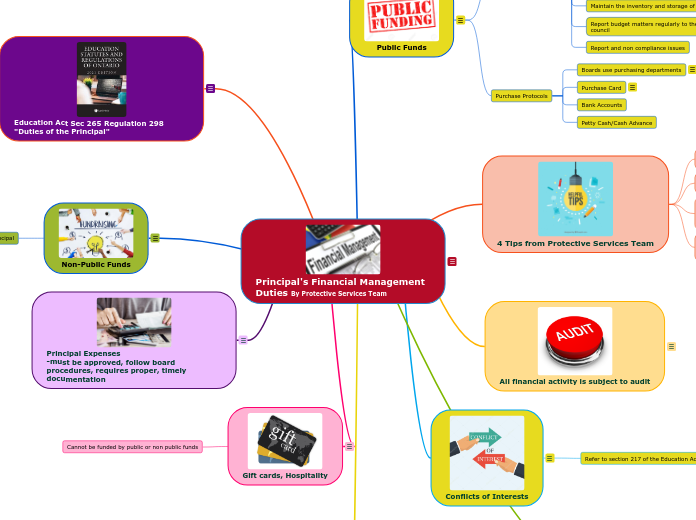

Principal's Financial Management Duties By Protective Services Team

OPC's magazine The Register. Written by Protective Services. They are a team who provides advice and legal support that is tailored to the specific needs of principals and vice-principals.

Gift cards, Hospitality

These are provided by the principal's own reserve (bank account). Boards have protocols related to providing food for meetings or small tokens of appreciations which must be adhered too.

Cannot be funded by public or non public funds

Principal Expenses

-must be approved, follow board procedures, requires proper, timely documentation

-Reimbursement can happen

- for approved purchases

- they must follow board procedures

- include original receipts submitted in a timely manner

Non-Public Funds

Monies raised through other sources (fundraising, student fees, school events, cost recovery events like field trips, pizza days

School council fundraising

Must adhere to rules around fundraising in regulations 612 section 22 and 24 . Namely the activities are conducted in accordance with board policy and the activities are approved by the board and the funds are used in accordance to policies established by the board.

Subject to Regulations under the Education Act

Reg. 612 Sec 22, 24

Proper filing of source documents

Regular reconciliations requiring receipts/invoices

Keep separate bank account

Responsibility of the principal

- Under the direct responsibility and authority of the principal

- PS highly recommends separate bank account for public funds

- Regular reconciliations requiring original receipts and/or invoices to prove compliance

- Proper filing of source documents (donors, fundraising results,receipts)

Education Act Sec 265 Regulation 298 "Duties of the Principal"

Each district school board has policies and procedures outlining the financial responsibilities of the principal. These are linked to the Education Act s. 265 Regulation 298 Duties of the Principal

The information and advice presumes that you have already read and understood your own board’s requirements.

Thanks for making it this far:)

Main topic

Conflicts of Interests

eg activities that can result in personal gain or a family member or close associate

conflict of interest

- can have serious consequences for an employee. Refer to section 217 of the Education Act.

Also check with your boards business office before proceeding with the transaction if in doubt

Refer to section 217 of the Education Act.

All financial activity is subject to audit

Either on a random, scheduled or targeted basis and either internally by board business staff or externally by the board auditory. This is why it is important to ensure that proper procedures and record keeping are maintained

4 Tips from Protective Services Team

Purchase cards may not be used for personal items. Using purchase cards for personal items may lead to serious consequences, up to and including dismissal.

Your number one criterion for decision-making when allocating funds and resources is the impact on student learning. Is this expenditure aligned with your current school and board practices?

Transparency and accountability are two key concepts to guide you in managing your school budget.

Do not hesitate to ask for training or advice from your board's Financial department.

Public Funds

Public Funds refer to the portion of the board budget created out of public funds or grants from the provincial government. These are distributed to the school for the purchase of items such as instructional items and office supplies and services.

Purchase Protocols

Petty Cash/Cash Advance

Bank Accounts

Purchase Card

Purchase cards

- Credit cards can be used to expedite small purchases

- Requires retention of original receipts and explanation of how the purchase aligns with school budget

- Exclusions include gas, alcohol, hotels and personal purchases

- Improper use can result in discipline and even termination

Bank accounts

- Boards generally require that a school bank account have two signatures from the school and the account must be registered in both the names of the school and the board

- Monthly statements, supporting original receipts are required

- Can only be used for public funds

Petty Cash/Cash Advance

- These budget lines provide a sum of money to allow schools to buy small items directly instead of using a purchase order

- Requires original receipts to be reimbursed

- Never leave money in classroom. It should be forwarded to office

- The counting of cash should be completed by two people and stored in safe

- Deposit to bank account as soon as possible

Boards use purchasing departments

Why?

- They can obtain best pricing due to purchasing in bulk

- The process is an open competitive process that is fair to taxpayers

- This ensure certain standard are maintained

- They also include service contracts and guarantees

- Purchasing from an non-approved can violate contracts

Duties of the Principal

Report and non compliance issues

Report budget matters regularly to the board, staff and school council

Maintain the inventory and storage of resources

Scrutinize and sign documents

Inform and train staff on budget matters and procedures

Monitor monthly expense reports

Use tracking procedures for expenditures

Allocate the funds

- Allocate appropriate amounts of public funds to to the budget

- Implement board approved tracking procedures for expenditures

- Monitor monthly expense reports provided by the board

- Inform staff on the process for spending, reimbursement, budget approvals and all other matters of a fiscal nature. responsibilities and procedures

- Scrutinize and sign all financial documents

- Maintain the inventory and storage of resources

- Report regularly to the board, staff and school council with respect to budget information, spending, and status

- Report and non compliance issues immediately to the board