によって Mitchell Pape 4年前.

168

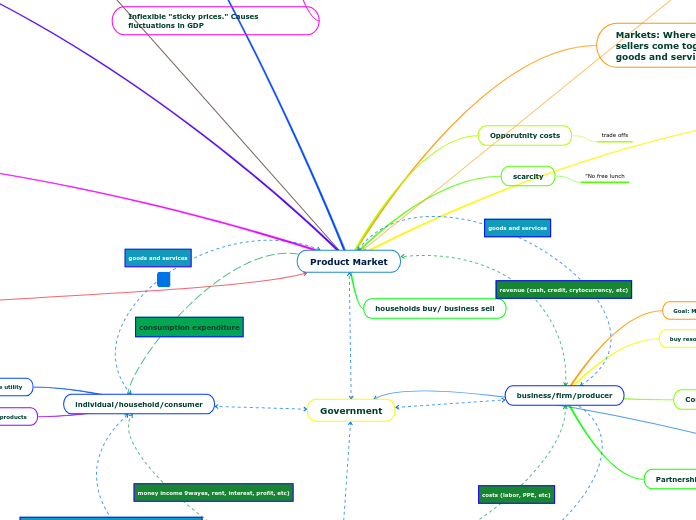

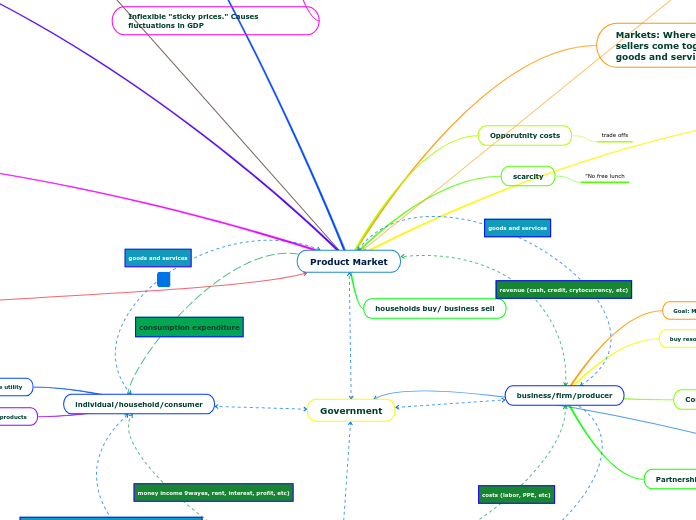

Product Market

The text outlines various economic and financial concepts, beginning with definitions of nominal income and producer surplus, which highlight the distinction between expected and actual earnings.

によって Mitchell Pape 4年前.

168

もっと見る