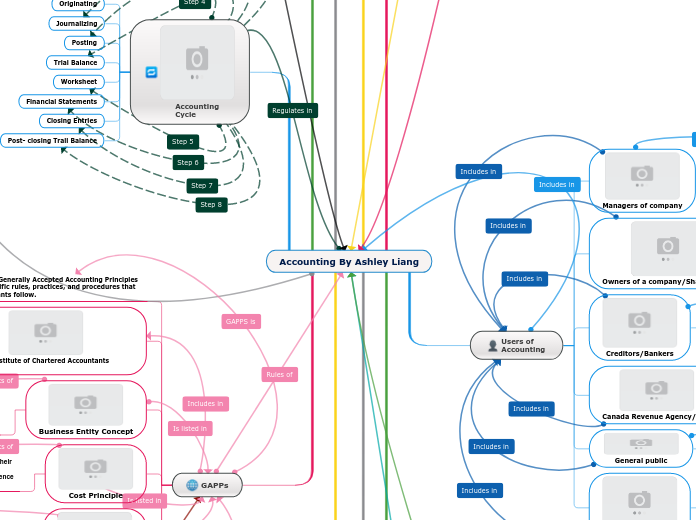

Accounting By Ashley Liang

Type in the name of your organization and press Enter.

Fundamental Accounting Practice

If you win the investment or support that you need, where will you start?

Account Balances

Exceptional Balances

- How will you manage risk in your plan? What could go wrong?

- How are you planning to reduce the chances of a problem occurring?

- How are you planning to reduce the impact if it does?

Add a risk.

Balances that are opposite their “normal” may either be due to a mistake, or may in fact be an exceptional (abnormal, opposite) balance.

Ledger

Correct the Trial Balance

If the Trial Balance is still out of balance at this point, you must start again (re-calculate the Trial Balance), as you missed the error.

Check that each transaction entered in the ledger is balanced. (Debits = credits)

Recalculate the balance in each ledger account to ensure accuracy.

Check to see if each account balance from the ledger was copied correctly to the trial balance.

Check the addition of each column in trial balance

Create Trial Balance

Add up the two columns. If the totals are equal, then write them and draw a double underline beneath each total, which is now referred to as the “balancing figure”. If the totals do not balance, then all errors must be found and corrected.

Transfer the final balances (circled) from the ledger to the proper column of the Trial Balance. Place the debit balances in the debit column and the credit balances in the credit column.

List all the accounts in the proper order.

(Assets follow liquidity order; Liabilities follow order in which they have to be paid and (AP goes first)

Start with a three-lines heading.

Left= Right / DR=CR

A listing of accounts (in ledger order) showing debit/credit balances for each account.

DR/CR Theory

Debit means Left Side of the account.

Credit means Right Side of the account.

T-Accounts

- What are the next steps in your plan?

- If you win support, where will you begin?

- If you don't, what is your backup plan?

Add the next step.

Enter the amount on either as either a debit or credit

Enter the account balances into each ledger account

Make the T- Accounts

Transaction Analysis Sheet

Objectivity Principle

1. Ensures that different people looking at the

evidence will arrive at the same values for

the transaction.

2. Accounting entries will be based on fact, not

on personal opinion or feelings.

Source Documents/ Original Record

1. Source documents are kept on file as they provide proof that transactions occurred.

2. For future reference purposes as they may be required for audit purposes.

3. A source document for a transaction is almost always the best objective evidence available to maintain objectivity.

A business paper or document that verifies the

transaction and dollar amount

Business Transaction

What are the key points in the implementation of your plan? How will you know that you are making real progress?

Think about:

- Signing key agreements and contracts

- Appointing new staff

- Completing development and design work

- Prototypes and successful trials

- Events and campaigns

- First production

- First sales

- First press coverage and reviews

Add a milestone.

Any financial event that results in a change in financial position.

EX. Phone bill, store receipts, cheque copies,credit card slips, purchase orders, etc.

A sheet that recording changes in a business's financial position, It also illustrates how business transactions affect financial position.

What are the key points in the implementation of your plan? How will you know that you are making real progress?

Think about:

- Signing key agreements and contracts

- Appointing new staff

- Completing development and design work

- Events and campaigns

- First production

- First sales

- First press coverage and reviews

Add a milestone.

GAPPs

You will need credible forecasts of profitability and strategic benefits if you are proposing investment in your business.

Principle of Conservatism

1.States that the accounting for a business should be fair and reasonable.

2. States that accounting will be recorded on

the basis of objective evidence

3. Financial reports should present realistic numbers

4. Accountants must make evaluations, set procedures, and provide estimates that ensure assets and profits are neither understated nor overstated.

Your profit and loss (or income) forecasts should detail where, when and how profitability will be achieved.

Add a highlight from your Profit and Loss forecast.

Consider making forecasts for year 1, year 2 and year 3 of your plan.

Continuing Concern

Assumes a business will continue to operate/exist unless it is known that it will not.

How will your balance sheet change as a result of this initiative?

- What new assets will you gain?

- What liabilities will you take on?

- How will the ownership of equity change?

Add a key point from the balance sheet forecast.

EX. If a business is going out of business, then the value of the assets cannot be determined until sold.

Cost Principle

1. Accountants must record the value of assets at their historical cost price.

2. Ensures that different people looking at the evidence will arrive at the same values for the transaction.

How will your costs base change as a result of your initiatives? Think about:

- Changes in fixed costs and overheads

- Changes in variable costs with volume

- Changes in variable costs with better equipment, better processes or better product design

- Changes in materials costs with volume

Add a key point from the costs forecast.

EX. The original cost of the asset purchased must be recorded, regardless of the market value.

Business Entity Concept

1. Accounting for business must be separate from the owner's personal affairs 2. Accounting for business must be separate from other opinion or feelings 3. Accounting entries will be based on fact, not on personal opinion or feelings

How will sales increase as a result of your initiatives? Think about:

- Increased sales volume

- Increased average value of sales

- Increased sales to existing customers

- Opening up new markets and segments

Add a key point from the sales forecast.

EX. Owner's personal home should not be on the company's Balance Sheet

Canadian Institute of Chartered Accountants (CICA)

GAPPS=Generally Accepted Accounting Principles

Are specific rules, practices, and procedures that accountants follow.

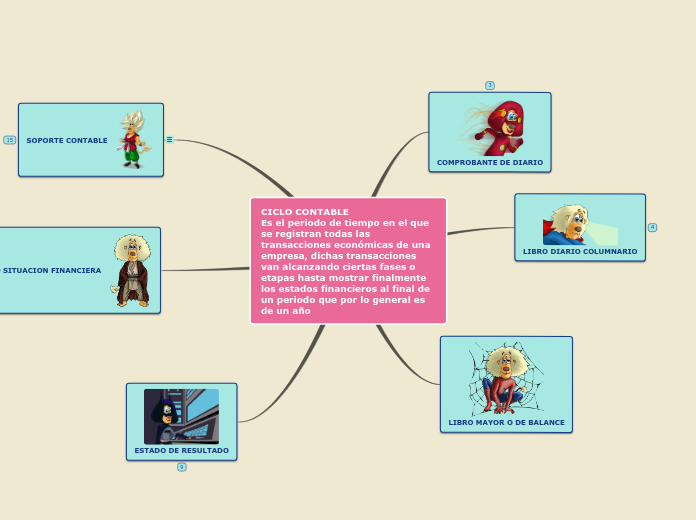

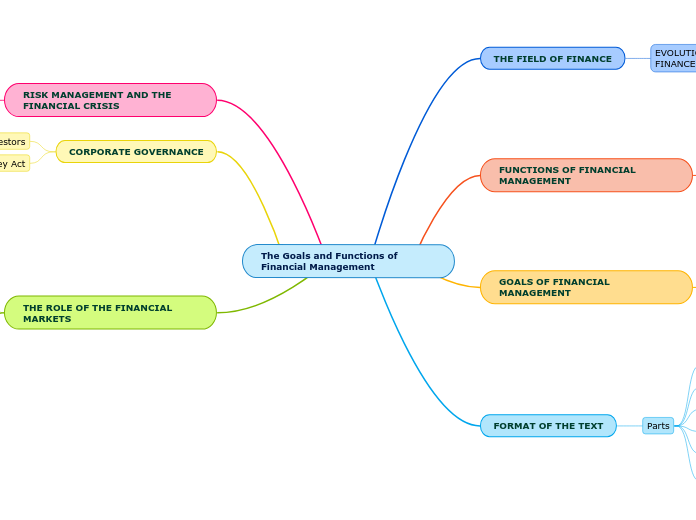

Accounting Cycle

The question that investors will ask is How will you turn your forecasts into reality?

Having identified your product or service, and the demand for it in the market, how will you reach that market?

Post- closing Trail Balance

Closing Entries

Financial Statements

Worksheet

Trial Balance

Posting

Journalizing

Originating

Bookkeeping

The tedious part—the systematic recording of amounts, dates, and sources of every revenue and expense generated in the company must be done regularly.

Accounting Basics

It must be clear to investors what you are asking for, when you need it and when & how it will be repaid - in short, what value they will get for their investment.

Create Balance Sheet

Put it all together

1. No abbreviations

2. No corrections or changes on sheet

3. Align figures and dollar signs

4. Dollar signs on first item in each column and

final totals only

5. Single underline columns to be calculated

Double underline final totals only

Total liabilities do not need double underline

Total Assets & Total Liabilities and Equity needs ( “$” sign + upper line+ double underline)

The first item and total has a “$” sign

Calculate the owner’s equity

List Liabilities (Bold + underline)

A/P always first

List assets (Bold + underline)

Cash always first

Determine the 3 lines heading

Add a sum-up of how this investment will be spent. Include:

- Purchasing assets

- Paying wages or overheads

- Buying stock and materials

- Investing in training or advisors

- Servicing loans

Balance Sheet

Owner's Equity

The owner's claim on the entity's assets/ the difference between assets and liabilities

1. Withdrawal

2. Loss on sale of an asset

3. Expenses

1. Sale

2. Investment

3. Gain in the sale of an item

Liabilities

Accounts Payable

Something that the owner owes

Things that the company/business owed

Assets

Claims Against Assets

Creditors

Accounts Receivable

The debts of customers

Resources owned by a business/company

The formal way of presenting financial

position, reports a person or

company’s assets, liabilities and owners’

equity.

Fundamental Accounting Equation

Add a summary of how much is required and when.

Assets= Liabilities + Owner's Equity

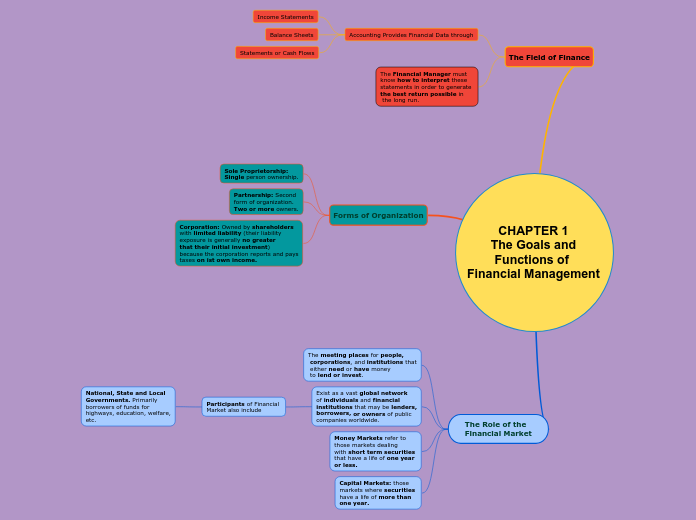

Forms of Business Ownership

Although the executive summary appears first in the document, it is easier to complete it last, when you can summarise and prioritize the key points in your plan.

Corporation

Shareholders

Provide capital, elect directors, receive dividends.

Directors

Hire executives, guide mission, distribute profits between business and shareholders.

bd

Executive

The executive runs the day-to-day operations of the business.

A special form of business that is owned by shareholders. Also called a limited company

Add the key points about the track record of your team and your capabilities.

1. Higher start up costs

2. Greater formalities

3. Requires annual maintenance from

accountant and lawyer

4. Losses cannot offset personal income

1. Limited liability of shareholders

2. Possible lower taxation rate

3. Can sue or be sued in the corporate name

4. More prestige

5. Continuity of business

Partnership

A form of business in which more that one person shares in the ownership and operation of a business

Add short descriptions of the key products and services which bring your mission to life and are making it happen.

1. Unlimited liability

2. Possible disagreements

3. Divided authority

4. Difficult to find partners

5. Partners liable for each other

1. Ease of formation

2. Broader management skills

3. Limited regulations

4. More capital resources

Sole Proprietorship

A business enterprise that is owned by one person and which the entire equity belongs to that one person

Summarise the value and the difference that your organization aims to create. Mission statements are more useful if they describe the difference that you want to make to your customer's lives, rather than what you want to achieve personally. Your mission statement should directly influence strategic decisions.

1.Unlimited liability

2. Difficult to raise capital

3. Llimited to owner’s knowledge

4. Lack of continuity

5. Profits taxed at personal rate

1. Low start-up costs

2. Great freedom from regulation

3. All profits to owner

4. Owner has complete control

Types of Business

Your business plan is a commercially sensitive document and you may wish to add a confidentiality statement (or non-disclosure agreement) at the front of the document.

Type in or attach your statement of confidentiality

Not-for-Profit

Carries on activities to provide a social benefit not for financial profit and accounting records must be kept accurate as they receive funds or tax-

deductible privileges from the government.

EX. Churches, Cancer Society, Community Hockey League

Merchandising

Purchases a manufacturer’s product and resells it to another customer for a higher price.

EX. Clothing store, supermarket

Manufacturing

Purchases raw materials to convert into a new product and combines effort and materials to produce a new product, then sells these products to earn a profit.

EX. A farm that produces milk, grain

A construction company

Service

Sells effort that does not result in a material item.

EX. hairdresser, accountant, and nail salon

Users of Accounting

Provide your investors with a clear picture of your business: how it is structured, who owns it, who runs it, and how it is doing so far?

Competitors

Know and compare themselves to the performance of their competitors.

Add some information about your successes and achievements. Think about:

- Significant orders placed

- High profile customers you have won

- Innovative 'firsts'

- Case studies

- Awards, endorsements and recognition

- Accreditation, such as certification to ISO standards

- Patents and rights held

General public

Understand the quality of an organization and why it invests or enters a job

Add some information about important partnerships. Think about:

- Organisations you have partnered with

- The strategic advantages of relationships

- What dependencies you have on other partners

- Participation in industry associations

- Independent professional advisors and coaches

Canada Revenue Agency/CRA

Requires the financial reports and figures to calculate the amount of income tax a company owes to the government.

Who are the key members of your management team, and what are their skills and experience?

Creditors/Bankers

See if the organization has the ability to pay off the bank loan

Add some information about the current shareholding.

How much have the current owners invested in the business?

Owners of a company/Shareholders

They observe the organization and decide whether to continue investing

Add some information about the regulatory environment that affects your company. Apart from company law, what other regulations apply to your sector? Consider:

- Bodies or associations with a code of conduct

- Privacy and data protection

- Insurance requirements

- Health & safety

- Professional training standards

- Equality and opportunity regulations

- Working with vulnerable groups

Managers of company

They look at how well the organization is doing to make business decisions (i.e. purchasing)

What is the legal status of your organization? Are you a sole trader, a limited company with shareholders, or a non-profit?

Activities of Accounting

Describe the vision and the opportunity that the plan is based on.

The investor's question you answer here is Where are you headed, and why?

Establish controls

to promote

accuracy and

honesty

Prepare

information

reports and

summaries

Rearranging,

summarizing

and classifying

information

Preparing

and collecting

permanent

records

Gathering

financial

information

Definition of Accounting

A. Paints an overall picture of your company B. Encompasses payroll C. Summarizes, analyzes, verifies and reports results

A system of dealing with financial information that provides information for decision making. Also